Canadians feel less secure with their finances, and those facing debt default scramble to find ways to silence their reality.

By silence, I mean figuring out their debt so they can avoid bankruptcy or other aggressive forms of debt repayment.

Understanding what debt default means before you accept any form of credit should be a priority.

These days, Canadians lean more towards using credit cards as they can be the easiest way to make purchases or pay off debt with a balance credit transfer.

Related: Canadians at record high credit card debt as inflation remains HOT

Debt can be a vicious cycle and, most importantly, crippling for anyone who carries it.

The concept of ‘buy now, pay later‘ is a debt trap that can consume and haunt you for years.

No one cares about why you can’t pay your debt; they want their money.

If you can’t afford to take out credit or a bank loan, put the brakes on your pen.

Common Debt Default Questions

Today, I want to go over some common questions about a debt default in Canada.

- What is debt default in Canada?

- Is default the same as debt?

- How to eliminate a debt default

- Should you co-sign for a loan?

Please note this post may contain affiliate links where CBB gets a small commission if you use a particular product.

What Is Debt Default?

Debt default is when you fail to repay a loan you signed or co-signed for in Canada.

Example: Bank (lender) lends you (borrower) $5000, which needs to be paid back monthly at a specific interest rate.

Ideally, paying off the debt fast will net the least amount of interest paid.

In the lender contract that you, the borrower, sign for a loan, you must be aware of the provisions.

For example, you may be in debt default if you fail to make one payment on your loan.

Don’t just look at the amount of money the lender will give you because that will be the least of your worries if you default.

When you sign an agreement to pay back a loan called “debt,” you are responsible for following the payment guidelines.

Depending on the loan contract, you may not go into debt default until you miss x amount of payments.

It’s always important to read the fine print when applying for a loan and to ask questions.

Typical Types Of Debt Default Loans

- Car loan

- School Loan

- Mortgage

- Credit Cards

- Personal Loan

What Happens If You Don’t Repay Your Loan?

First off, if you don’t repay your debt, you will be slapped with late fees, which only increases the amount you owe.

Also, a bank does not write off a loan, so you get away free without paying back what you owe.

When you sign for a loan, you could lose it if it is a secured loan, meaning you have collateral.

For example, you get a bank loan for $25,000 secured against your home.

When in debt default, the bank may be able to use the asset as collateral to pay the debt and retrieve any losses.

Selling A Default Debt

Also, if you default on your loan, the lender may allow you to catch up, or they will sell your debt to a collections agency.

The lender would rather recoup some of the money than lose all the capital. Besides, they don’t have time to track you down.

Trust me; you don’t want your lender to sell your debt to the devil because they will hound you for years.

Debt collectors will do anything to recoup the debt they just bought.

It’s not an uncommon practice for debt collectors to call an employer, friends, or family members to find out where you are.

Debt collectors can get a court order to garnish your wages once they find out where you work.

When you default, your credit score will be affected and stay on your report for at least seven years.

A low credit score or reports of debt default may impact future loans if you want to buy a car or a home.

Even applying for another credit card if you pay off your debt may be challenging.

How To Eliminate Debt Default

Budgeting is the only way to eliminate debt; you should do this before you take out a loan.

You don’t want to discover that you can’t afford the car loan after you accept the car.

Ideally, you will want to pay your debt off entirely or follow the debt repayment schedule until it’s eliminated.

Before a debt goes into default, talk to the lender to see if you can work out a plan.

Perhaps the lender will reduce the amount you owe and settle on an affordable new principle.

If the debt has already been sent to a collector and is on your credit report as in default, you will have a mark.

However, if you pay your debt in full, the lender may change the outstanding debt on your credit report to paid in full.

At the least, a potential creditor can see that you may have fallen on tough times, but you did repay the loan.

If you’ve done everything, including trying to refinance the loan, speak with a credit counsellor.

Is Default The Same As Debt?

No, debt is the amount of money you owe, and default is like going to the corner when you are bad.

When you fail to repay a loan, it becomes a debt default, meaning you did not live up to your end of the deal.

Should You Co-sign For A Loan?

I’m not a fan of co-signing for a loan and probably will never do so in my lifetime.

Mrs. CBB and I have no intention of getting involved in anyone’s financial problems where we place ourselves in the middle.

Remember that if you co-sign for a loan, even if the person paying back the debt wipes their hands clean, you’ll be on the hook for the total amount.

I’d tread lightly, primarily if you’ve found yourself in debt default because of someone else’s actions.

Even if you trust that someone will repay a debt they’d like you to co-sign, take caution.

Discussion: Have you ever gone into debt default? Would you please share with us what the process was like for you?

Thanks for stopping by,

Mr. CBB.

CBB Family Budget Report For November 2022

November Budget Summary

Hey Friends,

Tis the season to spend money, and we did in November on Christmas gifts, Birthday gifts, and January soccer registration.

Luckily we save for Christmas as it’s a monthly projected expense that includes our dinner.

Now that our son is getting older, we will have a look at our Christmas budget to see if it’s working in our favour.

Perhaps we might spend too much or too little for 2022, but we won’t know the final numbers until our December budget is completed.

As we wind down 2022, our monthly budget tabulations will give us a picture of how we spent our money.

Hopefully, we didn’t do too badly, but it may surprise us that we did go over one or two categories.

It’s okay to make mistakes with your budget because that’s how we learn.

Stick around in December when the 2023 Budget Binder is free for subscribers.

You can download the 2023 Budget Binder Excel spreadsheet from the Budgeting Tools and Resources page.

Happy December.

See you in January for the final 2022 Budget Update.

Mr. CBB

Year To Date Percentages 2022

Our savings of include investments as well as any savings for this month based on the net income of $11,647.44.

Equally important is that we save money on our projected expenses due in the coming months.

An example of projected expenses would be buying Christmas gifts in December or throughout the year.

All categories took 100% of our income, showing that we accounted for all the revenue in November 2022.

This type of budget is a zero-based budget where all the money has a home.

Budget Expenses Percentages For November 2022

Monthly Home Budget Breakdown

Below is a breakdown of our expenses which helps us understand where our money goes.

- Chequing– This is the bank account from which we pay our household bills. We use Simplii Financial, TD Canada Trust, and Tangerine Bank. Join Simplii Financial today! Read more about the best Canadian online virtual banks.

- Emergency Savings Account– This money is in a high-interest savings account (HISA)

- Regular Savings Account– This savings account holds our projected expenses.

- Monthly Budgeted Total: $6564.18

- Monthly Net Income Total: $11,647.44

- (Check out the Ultimate Grocery Guide to see where our grocery money goes)

- Projected Expenses: These are expenses we know we will pay for throughout the year = $852.91

- Total Expenses Paid Out: $9,479.33

- Total Expenses Paid Out: Calculated is $11,647.44 (total net monthly income) – $852.91 (projected expenses) – $1315.20 (Savings to emergency fund) = $9,479.33

- Actual Cash Savings going into Emergency Savings: Calculated is $11,647.44 (total monthly net income) – $9479.33 (actual expenses paid out for the month) – $852.91 projected costs) = $1315.20

Estimated Budget and Actual Budget

Below, you will see two tables: Our monthly and actual budgets.

Our monthly budget represents two adults and an 8-year-old boy.

Budget Colour Key: It is a projected expense when highlighted in blue.

Since May 2014, we’ve been mortgage-free, redirecting our money into investments and renovations.

Spending less than we earn and budgeting has been the easiest way to pay off our debt and save money.

Monthly Budget Amounts November 2022

Actual Monthly Budget November 2022

I’ll be back in January 2023 to share our December 2022 Budget Update and close off the year.

Keep reading below to see how our 2022 Budget Challengers are doing with their monthly budget report.

Thanks for stopping by to read our budget update.

Mr.CBB

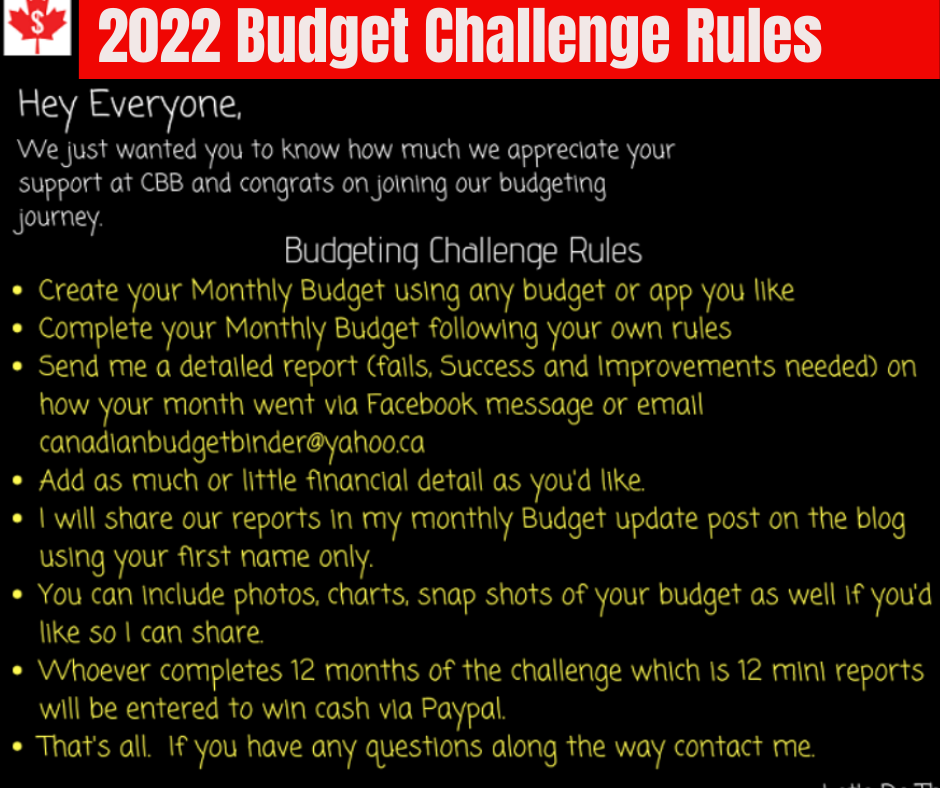

2022 Budget Challenge Canadian Budget Binder

Welcome to the 2022 Budget Challenge Reports.

Over the past two years, this challenge started with many positive CBB readers who wanted to join.

For 2022 we began with six people ready to change their lives by challenging how they manage a budget.

As of October, we have four budget challengers for 2022.

Each budget summary will always fall under the same Budget Challenger number below.

If you leave comments about any of the budgets, always use the budget challenger number, so they know it’s for them.

Budget Challenger #1

Income Nov. 11, $1234.8 + Nov 25, $1110.98

- Moe’s money 500

- Spousal support 700

- Sarcan 15

- Victoria cell 95

- Lotto winnings 670

Total Income = $ 4325.83

Expenses Budget Challenger #1

- Income tax 100

- Car insurance 90

- Car repair 0

- Cells 266.26

- Elec/water/power 260.28

- TFSA 500

- RRSP 250

- Crave 16.70

- Wifi 80

- Gas 100

- Groceries 400

- Home Insurance 110

- Alarm 54.33

- S.p.p. 50

- Water softener 30

- Water heater/ac/furnace 188

- Life insurance 75

- Lotto 7.50

- Entertainment 80

- Mortgage 560

- Parking 45

- Christmas 200

Total Expenses = $3463.07

Net Income = $4325.83

Total Expenses = $3463.07 = +862.76

- October was -1199.80

- November was +862.76

Now = – 337.04

Where my money went

I got more government money on Nov 14th of $500 dollars, but I’m still not voting for him.

Thankfully, I made 15 dollars from sarcan, which always helps. I got 670 dollars in winnings from Lotto and finished Christmas shopping.

One more month of budgeting left for the year, and I’m determined to end 2022 on a positive budget.

Mr. CBB – You won the lottery? Congratulations. I love your determination and motivation. Keep it up.

Budget Challenger #3

Hi Mr. CBB,

November budget had a big car repair, Christmas present purchases, and increased Restaurant costs. \

The car wouldn’t start for my hubby when he went to pick up the kids, so that was towed to the shop, and while there, winter tires were put on.

We have been doing private swim lessons and decided to eat out on those days since no one wants to make supper afterward.

And I got all the Christmas shopping done around Black Friday.

Budget Review 2022

Hubby and I will review the budget this coming month to see where we want our tweaks.

We are super happy we successfully got a full year of budgeting (though there are a couple of weeks to go).

To answer the last question, Mr. CBB, no, we don’t need the basement income; it just fluffs up the account, and it’s an area of the basement I don’t have to clean.

I’m also used to having someone down there since we have done that for about eight years. So why not make the extra side cash?

We rented it again in December, and they are on lease until the end of April.

| Income | |||

| Expected | $ 13,029.77 | $ 14,184.00 | $ 15,951.00 |

| A-Pay | $ 4,866.44 | $ 5,525.88 | $ 5,477.60 |

| K-Pay | $ 3,300.00 | $ 3,558.61 | $ 6,524.02 |

| CTB | $ 354.99 | $ 293.89 | $ 293.89 |

| Bluecross reimbursement | $ 285.00 | $ – | |

| 1st rent | $ 1,650.00 | $ 2,066.70 | $ 2,066.70 |

| 2nd rent | $ 850.25 | $ 939.75 | $ 939.75 |

| 3rd rent | $ 1,123.09 | $ 1,150.08 | $ – |

| 4th rent | $ 600.00 | $ 650.00 | $ 650.00 |

| Actual Income | $ 13,029.77 | $ 14,184.91 | $ 15,951.96 |

| Expenses | |||

| Charity | $ 50.00 | $ 40.00 | $ 50.00 |

| TFSA | $ 325.00 | $ 425.00 | $ 425.00 |

| Internet | $ 49.30 | $ 49.30 | $ 49.30 |

| Streaming | $ 20.98 | $ – | $ – |

| Electricity/Water | $ 250.00 | $ 250.85 | $ 189.54 |

| Natural Gas | $ 250.00 | $ 69.69 | $ 76.33 |

| Cell Phone | $ 40.95 | $ 40.95 | $ 40.95 |

| Fuel | $ 280.00 | $ 282.70 | $ 240.01 |

| Vehicle Maintenance | $ 413.96 | $ 881.45 | |

| Parking | $ 4.00 | $ 17.21 | $ 5.75 |

| Groceries/Household | $ 1,100.00 | $ 1,234.40 | $ 911.71 |

| Restaurant | $ 200.00 | $ 235.20 | $ 379.00 |

| Liquor Store | $ – | $ – | $ 75.00 |

| Clothing | $ 75.00 | $ 176.63 | $ 157.80 |

| Fun Money | $ 400.00 | $ 400.00 | $ 400.00 |

| Hair/Cosmetics | $ 30.00 | $ – | $ 45.41 |

| Professional fee | $ 35.00 | $ 35.00 | $ 35.00 |

| Kids Toys | $ 40.00 | $ 113.05 | $ 155.56 |

| Large Household | $ 250.00 | $ 26.09 | $ 679.44 |

| House Maintenance | $ 100.00 | $ 358.35 | $ 54.43 |

| Childcare | $ 950.00 | $ 697.00 | $ 822.00 |

| Pet Care | $ – | $ 39.34 | $ – |

| Miscellaneous | $ 100.00 | $ 361.94 | $ 410.84 |

| Maid service | $ 108.00 | $ 108.00 | $ 108.00 |

| Entertainment | $ 100.00 | $ 168.14 | $ 124.85 |

| Travel **A&M-taxes | $ 300.00 | $ 298.63 | $ – |

| Gym/Pool | $ – | $ 300.00 | $ – |

| Massage/Chiro | $ 200.00 | $ 406.53 | $ 350.00 |

| Bank Fee | $ 16.95 | $ 16.95 | $ 16.95 |

| Life Insurance | $ 230.93 | $ 230.93 | $ 230.93 |

| Auto Insurance | $ 173.81 | $ – | $ – |

| Home Insurance | $ 673.60 | $ 677.88 | $ 322.74 |

| Total expenses | $ 6,353.52 | $ 7,473.72 | $ 7,237.99 |

| Debt | |||

| LOC | $ 1,500.00 | $ 1,525.00 | $ 1,350.00 |

| HELOC | $ 157.85 | $ 296.99 | $ 315.84 |

| Mortgage 1 | $ 886.84 | $ 1,136.25 | $ 909.00 |

| Mortgage 2 | $ 908.16 | $ 748.82 | $ 1,123.23 |

| Mortgage 3 | $ 1,021.18 | $ 1,021.18 | $ 1,021.18 |

| Mortgage 4 | $ 1,556.94 | $ 1,612.98 | $ 1,612.98 |

| Total Debt | $ 6,030.97 | $ 6,341.22 | $ 6,332.23 |

| Every Dollar App Total | $ 645.28 | $ 369.97 | $ 2,381.74 |

Budget Challenger #4

Chilly greetings from the Yukon, CBB!

November, November, November…what a mess.

The unpaid leave I mentioned in my last update isn’t being processed until December, so I had to set aside money to cover that. Food spending was ridiculous.

Finally, I put a deposit towards drafting my will, and I had to order new cheques for my condo fees.

I forgot about a recurring deduction just after I moved money from the Projected Expenses account, which is how I wound up $6 over budget.

But the absolute kicker was supplied for gifts!

After his sister got a quilt from me this summer, my nephew has to have one… of course, his quilt will be bigger (twin-size vs. cot-size), and the materials will cost more.

Every time I’m tempted to grouse about it, I remind myself that I love him very much…and this is the last quilt he gets until he gets married.

I also stocked up on thread for weaving projects that will be gifted over the next year or two.

Budget Control November

Looking back on previous years’ tracking, November is often when my spending gets out of control.

It’s so dark, I’m so tired, and I feel like I’ve been good all year and should be able to do something crazy.

I’ve made a note about it right at the top of the page for November 2023, so we’ll see if that has any effect.

It’s hard to believe this year is almost over! Stay warm, everyone!

Budget Challenger #5

- 126.65 car maintenance

- groceries 88.04

- 38.76 fast food

- 1217.50 car repair

- 26.36 entertainment

- 99.62 vet

- 106.82 gas

- 1227.97 vacation

- 110 internet

- 10.75 health

- 73.33 gifts

- 72.94 phone

- 300 short-term savings

- 148.56 power

- 168.92 insurance

- 401.80 land tax

- 250 assorted

November At A Glance

Happy almost new year, all! November was a super expensive month for me, and to top it off, I decided to go on vacation too!

November is always extra expensive because I have my MVI and regular things like switching out tires, oil changes, and whatever to prepare the car for winter.

I also have my land tax payment. Unfortunately, to pass my MVI, I had to do a lot of extra work – I’m hoping it pays off in the end; I’m getting closer and closer to 300K.

We had talked about starting to look for another car. Still, I can’t take it on right now, so we need to hold out hope the car sticks around a bit more because there are very few vehicles around; most are vans, trucks, or SUVs if anything is available, and I would be looking for a small car…so we shall see.

I also had a vacation. Flights were way more expensive than I usually pay, but I left my holiday to the last minute to plan, but in doing so, I got a fantastic cruise deal.

For hotels and car rentals, I used Air Miles, and for most days, I wasn’t on the cruise, which was good and helped.

You’ll notice I put a random $250 at the bottom of my list. My boyfriend isn’t working and has run out of savings, so I left that in a drawer while I was on vacation.

I asked him to keep the receipts, but he didn’t. Based on how much I have written down for groceries, I’m guessing most of it went to that and maybe gas.

We also had an unexpected trip to the vet. Not as bad as it could be, but the kitty has asthma, so we’ll have to monitor it. He seems okay for now, but it may be an expense.

December Budget Predictions

I’m predicting December to be a bit expensive with my phone bill – as I use data for GPS while in the US.

I have a roaming package, but it has a cost per day whether you use it or not, so that adds up. Plus, I am finishing out getting stuff for Christmas and seeing family between 2 provinces.

Happy almost new year, all! November was a super expensive month for me, and to top it off, I decided to go on vacation too!

Subscribe To Canadian Budget Binder

Get CBB By Email + My Free Emergency Binder Printables!

Subscribe To the Canadian Budget Binder And Get My Exclusive CBB Emergency Binder FREE!

The post What Is Debt Default? : November 2022 Budget appeared first on Canadian Budget Binder.