If you want budget motivation, ideas, community help and are committed to 12 months of budgeting, join us for our 2022 Budget Challenge.

This will be our third annual, monthly budget challenge, and I’m dedicating it to Mary. You would have heard of Mary if you’ve been on my Facebook page or read blog posts.

She was a shining star on Canadian Budget Binder ever since I hit publish on my first blog post in 2012.

Passion for finding ways to save money and stick to their monthly budget and investing was her hobby.

The best part was that her husband joined in and helped Mary keep their budget on track.

I’m not sure, but I think he even had an allowance as I do because she gave me the idea.

May she rest in peace however I’m sure she’s watching over us. I know those of you who know here can hear certain things she would say and smile. We do.

Challenges Help Make Changes For Life

So, the 2022 Budget Challenge Is for all challengers to change how they view, spend and save money.

- Change how you view money and understand that once it’s gone, it’s gone.

- Spending money you don’t have will cause a debt disaster. Work on spending ONLY what your budget allows.

- Save more money that you have ever saved before while paying off your debts and not creating more debt.

No More Excuses about creating debt and spending outside of your budget. Find what you don’t need to spend money on and get rid of it.

For example we cut our home phone and our cable and don’t miss it one bit.

I got set up with Freedom Mobile and pay 21.99 for 2gb of Data every month. Far less than the home phone ever was with Rogers.

With the mobile phone that I acquired from Mrs. CBB I find it easier to blog, bank, use savings apps, finish surveys for cash etc.

I can earn money while I’m waiting for a meeting or sitting at the doctors office. Isn’t that crazy?

My favourite savings app by far is Rakuten and we really do like the big, fat cheques they send us.

I never thought I’d be into a mobile phone the way that I am especially to order from Home Depot, Canadian Tire and almost all the store I shop at.

No more home phone for us.

Lastly before we get into today’s blog post I wanted to say that Mary would be proud of all 2022 Budget Challenge participants as she was for the 2021 gang.

Today, I want to talk about the 2022 Budget Challenge and what we’ve learned over the past two years.

Motivation For Success Works When You’re Challenged

When I started this budget challenge, I was so excited to see many people sign up.

Over the year, many of them quit the budget challenge with an excuse.

Finance is not something you stop doing because it’s a BIG part of your life.

Even if you miss even one month of the budget challenge, you’re out of the challenge.

The challenge is to visit your budget daily and not on the last day of the month where you are scrambling to send me your information.

This challenge is strict and meant to motivate you to never give up on yourself. I’m trying to show you how important a budget is why you need to keep on top of your finances.

We still budgeted when we had funerals to attend, one to arrange, and other family member issues.

If you have a severe problem with no possible way to budget, please let me know.

Your budget will be the most important financial document to help get you through any time something happens.

You are spending more money than you have to should not happen, especially if you have emergency savings and projected expenses.

Projected expenses start at the beginning of the year, so read up if you want to add them to your budget.

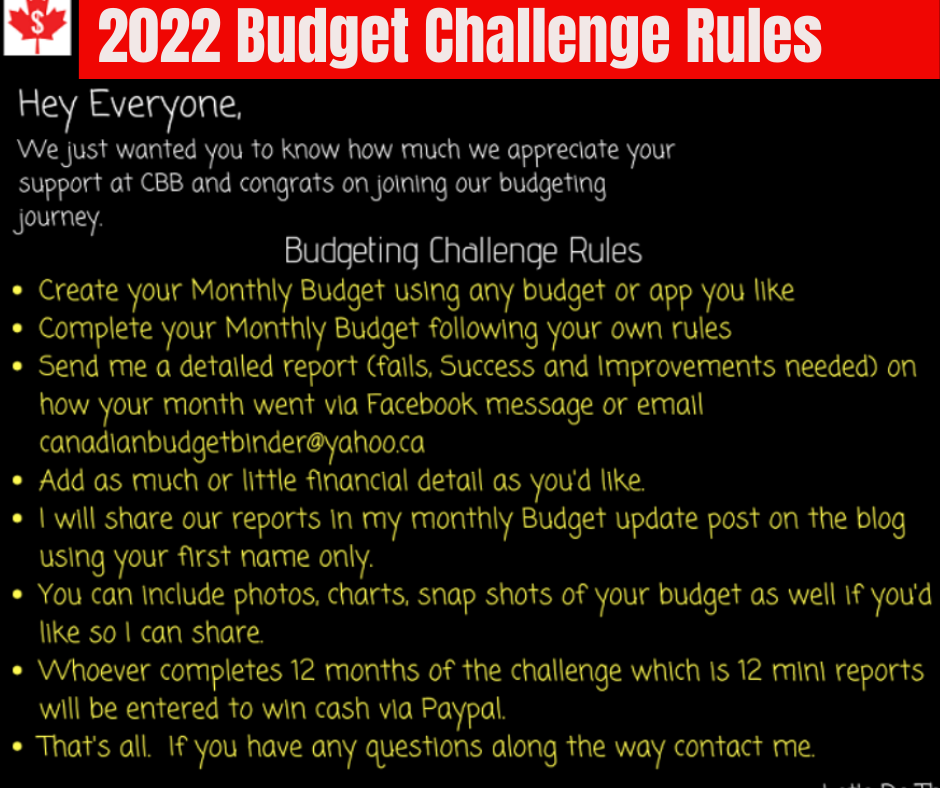

2022 Budget Challenge Rules

The rules for the budget challenges have not changed since it began.

All I ask is that you have your budget sent to me on time.

I will send each participant a date to have it emailed to me, which is typically the second week of each month.

The monthly budget update for our family goes up simultaneously as the challenge on the Thursday of the second week.

I also ask if you can type your budget in a word document only or an email. Do not use bullet points or unique fonts or sizes.

The reason for this is that I have to go back and change it all because that’s not what I use on the blog.

Times New Roman is what I do use and size 18.

Do not send me a Pdf document, and if you send me, photos attach them to your email as a jpeg.

If at all possible, please reread what you’ve written and checked for errors or grammatical errors.

Do not start a sentence with the same word, one after another.

Please make sure it is complete when you write a sentence, so I don’t have to guess what you mean.

I will run each entry through Grammarly to check for errors or ways to improve a sentence for everyone.

Honestly, I was shocked at the errors I made and missed in my past and current blog posts.

The idea of the write-up you sent me is to share your budget numbers, where you went wrong, any success you had etc.

If you screw it up, own it and move on for the next month.

Set time aside to do your budget as I’ve had so many people drop out that it worries me.

Make budgeting a part of everyday living and kick debt to the curb.

If you have any questions, ask me when you contact me to sign up.

MR.CBB

CBB Family Income Report

Where Did The Money Go In October?

One of the happiest moments for anyone who uses a budget is when you come in under budget.

In October, we came in under budget, and we are so proud of our accomplishment as it’s been a rough year for us.

However, we still could have done better, but as we begin to create our January 2022 budget, we can look back and see the areas that need better maintenance.

As you can see below, we went over budget in the grocery category by $200 because of Thanksgiving and Halloween.

I’ll be addressing that today because it was something that we did not account for in our grocery budget.

Also, going to Costco does boost how much money you spend in most budget categories.

I’ll discuss that and how we plan to get in and get out in 2022 without more than we bargained.

Lastly, in October, we bought Christmas gifts for five people, which we saved as projected expenses.

I can’t believe Christmas shopping is almost complete for our family. I’m the official gift wrapper as Mrs. CBB is horrific at wrapping. She’ll agree to it.

We will also be planning our Christmas dinners because last year we spent WAY too much on food.

We follow the Catholic observations for the holidays throughout the year.

There will be a fish dinner on Friday, Christmas breakfast, and dinner and New Years’ food.

Another thing we plan to do in 2022 is to track what we sell for the year.

I’ll talk about that in another post because I’ll be including another free budget binder printable.

Have a great November.

Mr.CBB

Family Budget Percentages October

Our savings of include investments as well as any savings for this month based on the net income of $11,047.53

Equally important is that we save money on our projected expenses for upcoming expenses in the coming months, such as Christmas.

All of the categories took 100% of our income which shows that we accounted for October 2021.

This type of budget is our favourite and is called a zero-based budget, where all the money has a home.

If you’re interested in using the same budget, we are I’d read about the zero-based budget.

Monthly Home Budget Expenses

Below is a breakdown of our expenses which helps us to understand where all of our money goes.

- Chequing– This is the bank account where all of our debt gets paid from. We use Simplii Financial, TD Canada Trust, and Tangerine Bank. Join Simplii Financial today! Read more about some of the best Canadian online virtual banks.

- Emergency Savings Account– This is a high-interest savings account.

- Regular Savings Account– This is a savings account that holds our projected expenses.

- Monthly Budgeted Total: $6570.80

- Monthly Net Income Total: $11,047.53

- (Check out our Ultimate Grocery Guide to see where our grocery money goes)

- Projected Expenses: These are expenses we know we will pay for throughout the year = $852.91

- Total Expenses Paid Out: $6247.18

- Total Expenses Paid Out: Calculated is $11,047.53 (total net monthly income) – $852.91 (projected expenses) – $ 3947.44 (Savings to emergency fund) = $11,047.53

- Actual Cash Savings going into Emergency Savings: Calculated is $ 11,047.53 (total monthly net income) – $6247.18 (actual expenses paid out for the month) – $852.91 (projected expenses) = $3947.44

Estimated Budget And Actual Budget

Below you will see two tables: our monthly budget and the other is our actual budget.

This budget represents two adults and our 7-year-old son.

Budget Colour Key: If highlighted in blue, that means it is a projected expense.

Since May 2014, we’ve been mortgage-free and redirecting our money to investments and renovations.

When creating your monthly budget, try to eliminate the feeling of comparing your financial numbers as every situation is unique.

Spending less than we earn and budgeting has been the easiest way to pay down debt and save money.

One last thing, situations change, and sometimes we spend less, or we spend more.

Monthly Budgeted Amounts October 2021

Actual October 2021 Budget Results

We are now down to the last two months of 2021, and I want to prepare for 2022.

If you would like to participate in the 2022 Monthly Budget Challenge, please message me through the contact form on the blog or email me at canadianbudgetbinder@yahoo.ca.

We started with high numbers at the beginning of 2021 and are down to three people still in the challenge.

I’m so proud of them, and I know if Mary were still with us, we’d have a fourth participant as she never missed a month.

Would you mind sharing this post with your friends or telling them about it? My budgets are free for subscribers, and so is the help from myself and other readers.

This is a family blog where we all come together to share experiences, failures.

Budget Challenger #1

October was interesting.

My son is still trying to get a job, and my daughter is living with us now.

It’s excellent; however, I need to adjust my budget and get more overtime at work.

We had Thanksgiving and celebrated my son’s birthday in October, which added extra costs.

I sold my tires from a previous car for 100 dollars, got paid 3x this month, SGI rebate 31.40 dollars and Sarcan 3.40 dollars.

I’m back into playing lottos and Pokémon.

I went over on gas by 80 dollars, groceries by 250 and takeout by 120 dollars.

I’m working on adjusting our monthly budget for November to account for my daughter living with us.

Budget Challenger #2

Good morning all,

I’ve been with my money lately with how lousy I’ve tried to be a bit smarter.

In September, I had what I think is my first non-sufficient fund’s charge, and guess what, I did it again!\

It’s frustrating because I have the money to pay it, but I honestly thought I had more money available in my account.

I had a notification set to let me know if I dipped below $100, but I guess it doesn’t count pending charges which I thought it did, so I went over it again.

Typically I pay my credit card bill once a month, but now I’m going to try to pop into it any time I make a large purchase.

Speaking of large purchases, I got my pay from a side job I do. I only get paid twice a year, and it’s not a huge amount, but I get $1000 each pay.

It is to go towards professional development for my industry, but we can spend it how we see fit. So I put $182.85 towards a virtual conference and $150 towards supporting a charity to win a home lottery.

I’m sure I’d never win, but I know someone who won a car through it a few years ago, so you never know if you don’t try. The rest of the pay is going into savings.

Since I have been wrong with money lately, I did an inventory of what was in the house and bought minimal groceries this month ($160 worth)

I tried to focus on using canned items and things getting pushed to the back of the fridge and freezer.

Also, I only spent $65 on fast food, which is fantastic for me, especially where I travelled this month. Though the trip hurt my wallet, I paid $175 for gas.

I had planned to get tires in October but decided to hold off until November.

Doing so was probably a wrong decision since I also have land tax and car registry due.

Oh well, I can’t win them all!

Budget Challenger #3

Hi Everyone,

- Month of October had an extra pay day but in the end it all still works out the same. Mind you I was able to make extra mortgage payment and extra SUV payment. That’s a bonus.

- Purchased items to stage my home for selling. Shared the cost with daughter to take kids to a Van Gogh show in Saskatoon and supper (was not budgeted). So, this last-minute surprise put me over on budget amount for shopping. What an incredible viewing of his masterpieces. I purchased a winter jacket for me as I needed a new one. In total I spent over what I had budgeted for by -$100.00

- Groceries were over due to birthday celebration and another supper for my daughter that I did not budget -$98.13`

- Budgeted to swap out Spring/summer to winter tires. I do store them at the tire shop. ($99.00)

- Dog needed grooming this month and this too was accounted for in my budget ($50.00)

- Entered November ahead $719.70 If only I could take that money and apply to RBC LOC

The End

Thanks for reading, and I will see you back in December for our November 2021 Budget and Budget Challenge Updates.

Please comment below if you have any questions about the CBB budget update or the budget challenge members?

Take care,

Mr.CBB

The post Join The 2022 Budget Challenge: October 2021 Budget Update appeared first on Canadian Budget Binder.