Changing into a financially educated machine sounds terrifying as it’s far more than just using a budget, as you will learn today.

We often catch ourselves telling our son that if you practice, you’ll get better when he gets upset.

It might be missing a goal at soccer where he says he’s not good enough to play like the other boys.

What he’s slowly coming to realize is that he can, and over the years, his soccer skills have grown, as did his confidence.

Since our son is autistic with a sensory processing disorder, he learns to do things differently to understand success.

The struggle is harder for him, but we encourage him to do what makes him happy, and he’s only 7.

It’s times like this when we realize the lessons we teach our son also apply to our financial journey.

The prime lesson is to never give up on something you’re passionate about.

Unfortunately, it takes more than that, but it’s either you do it or live without it.

Today, I want to share how we went about finance, mistakes along the way and where we are now.

Becoming Financially Educated From Our Parents

Our devotion to becoming financially educated escalated, as our parents had different opinions about money.

I must warn you that having your parents teach you about finance may not be your ticket to financial freedom.

Often the best motivation is life lessons that teach you what hardship looks and feels like.

From a young age, some children want to break the poverty chain once and for all.

That was us, but we didn’t entirely know the difference between poverty, middle class and the one percent group (millionaires club).

Another discovery was that our poverty views were shaded since there would always be someone who would switch spots with us. I hope that makes sense to you.

Life lessons often come with the gift of knowing about what you don’t want from life.

However, these gifts guide you towards what you want with no regrets.

We lived in a basement for two years after getting married and wanted to buy our first home.

However, the reason for renting a room was to save as much money as we could buy a house.

I wholeheartedly believe that debt freedom would have taken years to be fruitful if we had not delved into finance.

But that’s okay because wherever you are in your journey, it’s better to start than give up before starting.

Financially Educated Makes You Rich In Knowledge

Of course, we had goals to become wealthy and successful but laughed it off because we didn’t have power.

The power you give yourself is confidence, strength and perseverance. That’s how we went about creating a debt-free life.

By the age of 40, we had almost completed our anti- bucketlist; however, more was waiting.

I wanted to learn about investing, including all the jargon that mostly confuses people but pretend they know.

That was us many years ago until we started this blog, and it opened a can of rainbows instead of worms.

Learning To Invest Our Money

Learning to invest without a financial advisor is the biggest ticket currently sitting on our plate.

All we had was basic knowledge about financial literacy, and the more we filled the hole, it started to make sense to us.

Filling The Hole You’ve Dug To Achieve Success

Below is what we wanted to accomplish by the age of 40, and for the most part, we have.

Nothing about what is below is easy, and filling in the holes takes sweat.

- Go back to school upon arrival in Canada

- Build a career from what I had learned

- Buy a house together

- Become debt-free

- Invest for our future retirement

- Start a family

- Ensure our son was set up with life insurance, education and a non-registered investment

- Travel as long as we are healthy

- Live Happily Ever After

It sounds buttery and golden, although it took us years to get ahead of the money by becoming financially educated.

For those of you who think we are spoiling our child by leaving him money to get ahead, perhaps you’re right.

On the other hand, before he gets his hands on anything, we will make sure that he understands finance.

He will, after all, have this blog to manage and hopefully continue to share his financial journey in the future.

Financially Educated People Reduce Money Stress

We’ve come to an understanding our financial portfolio is far better than some people our age.

That didn’t give me the confidence I needed to invest in education.

It’s easy to hand money to a financial advisor you trust to build your retirement savings.

Some people don’t want to learn how to become their version of financial success, including investments.

Investing is something we wish we knew more about to build our portfolio without an advisor.

To be fair, that sounds scary as hell to us, and maybe you feel the same, but we still want to understand,

I have a defined benefit pension at work, live mortgage-free, debt-free, and the learning never ends.

There’s always a hole to fill, even if it’s just learning the basics of investing.

How We Started To Become Financially Educated

- Asking Questions to anyone who was debt-free and paid off a mortgage early.

- Reviewed Our Financial Situation and set up achievments we wanted to reach.

- Reading Canadian Finance books helped us to take a grip on the finance industry.

- Listening to Podcasts has been inspirational by teaching us money and finance.

- Watching documentaries about life on the streets, poverty, prision and successful entrepenurs.

- Starting a blog – Canadian Budget Binder

- Chatting to other finance bloggers on social media, mostly on YouTube and Twitter.

- Practice

As I mentioned above, learning never ends in the financial world, so buckle up and invest in yourself so you can invest yourself.

Before you go today, I hope you enjoyed our little bit of inspiration and motivation.

No matter thinking, you can’t do it, you can by practicing just as our son does at soccer.

Below you will find our February 2022 budget review as well the 2022 Budget Challengers share their month with money.

CBB Family Budget Report

February 2022 Budget Summary

Where did the money go? We didn’t do much in February besides grocery shopping, pizza, and Shoppers Drug Mart.

We have close to $6500 in regular Optimum Points as typing this. I know many of you said for us to use them, and we will, but we’re not sure how.

There was a hike in health expenses with driving back and forth to Hamilton, and I’m back to work now.

Our son has medical appointments to attend, as does Mrs. CBB, who goes weekly to physiotherapy.

We did go way over budget on groceries, and that’s because of our Costco shop.

Since the weather has been not so kind to use in Ontario, we decided to double up on sales items on our list.

Lastly, our kitten is picky, and we’re trying to find a food that he will eat, and we’ve found it, but it’s not so cheap.

We mix it with dry food, and he is enjoying that, so that we will stick with Hills Science Diet Cat food.

That’s about all apart from rising property taxes, but that’s boring; however, I am getting two years of my plate sticker costs returned.

Then I’ll turn around and put that savings into my petrol fund as I’m spending a fortune filling it up.

Thanks for reading, and please do leave comments, share suggestions and as always, treat people with kindness, even online.

Mr.CBB

Budget Expenses Percentages

Our savings ratio in February was almost 60% coming in at 59.16%, which is always a good thing.

Our life ratio has also increased with health appointments and medications.

Even with the massive spike in petrol, I’m betting our March will be higher than February.

Monthly Home Budget Breakdown

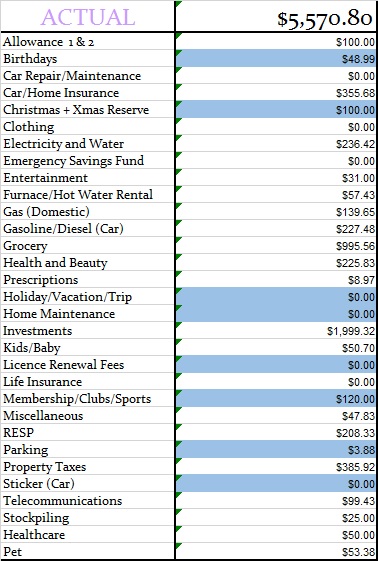

Below is a breakdown of our expenses which helps us understand where our money goes.

- Chequing– This is the bank account where all of our debt gets paid from. We use Simplii Financial, TD Canada Trust, and Tangerine Bank. Join Simplii Financial today! Read more about some of the best Canadian online virtual banks.

- Emergency Savings Account– This is a high-interest savings account.

- Regular Savings Account– This is a savings account that holds our projected expenses.

- Monthly Budgeted Total: $6590.22

- Monthly Net Income Total: $10,475.33

- (Check out our Ultimate Grocery Guide to see where our grocery money goes)

- Projected Expenses: These are expenses we know we will pay for throughout the year = $915.00

- Total Expenses Paid Out: $5570.80

- Total Expenses Paid Out: Calculated is $10,475.33(total net monthly income) – $915.00 (projected expenses) – $3989.53 (Savings to emergency fund) = $5579.80

- Actual Cash Savings going into Emergency Savings: Calculated is $10,475.33 (total monthly net income) – $5570.80 (actual expenses paid out for the month) – $915.00(projected expenses) = $3989.53

Estimated Budget And Actual Budget Report

Below you will see two tables: our monthly budget and the other is our actual budget.

This budget represents two adults and our 7-year-old son.

Budget Colour Key: It is a projected expense if highlighted in blue.

Since May 2014, we’ve been mortgage-free and redirecting our money to investments and renovations.

When creating your monthly budget, try to eliminate the feeling of comparing your financial numbers as every situation is unique.

Spending less than we earn and budgeting has been the easiest way to pay down debt and save money.

Monthly Budgeted Amounts February 2022

I will be removing the Sticker budget category for our vehicle when I post the March 2022 Budget.

One less budget category, although our petrol for the truck will be going up with the increased fuel prices.

Actual February 2022 Budget Report Results

Another month under our belt for 2022, but I’ll be back in April to share our March Budget Update.

Keep reading below to see how our 2022 Budget Challengers make their monthly budget.

Thanks for reading,

Mr.CBB

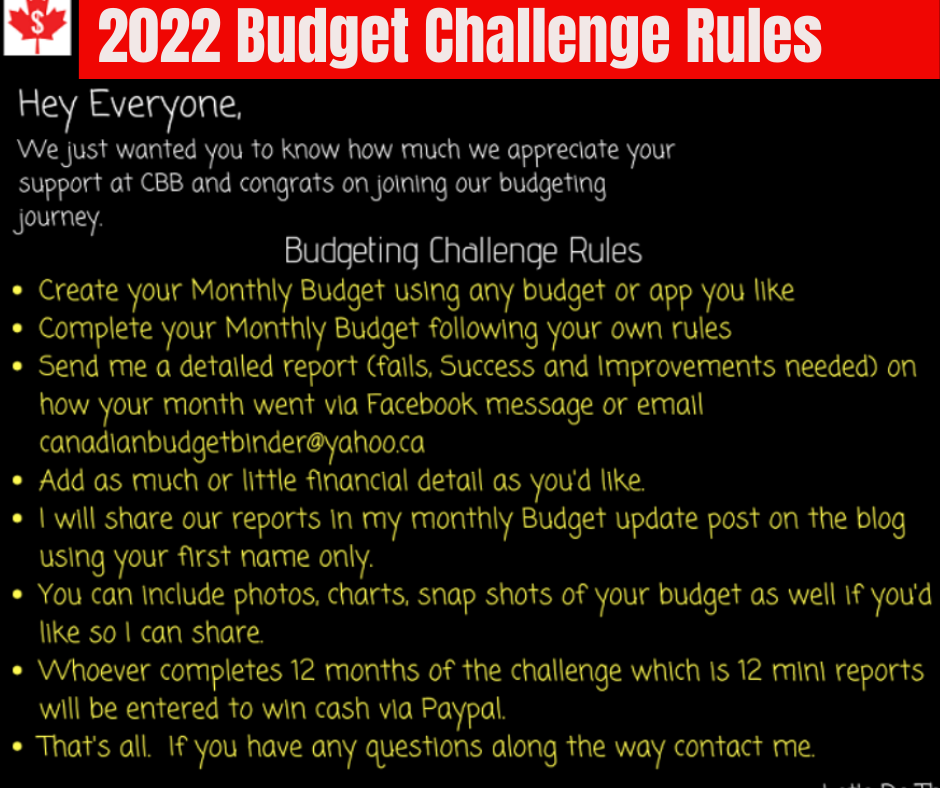

Budget Challenge 2022

Hello everyone, welcome to the 2022 Budget Reports from our challengers.

Over the past two years, this challenge started with many CBB readers who wanted to join.

This year was no exception; however, life gets in the way at the last minute, and someone needs to drop out.

No judgement from me whatsoever because you made it this far, and that’s progress.

For 2022 we are starting with six people ready to change their lives by challenging how they manage a budget.

One of our challengers had to drop out, but she will be sharing why in a blog post, so don’t miss that.

Each budget summary will always fall under the same Budget Challenger number.

Budget Challenger #1

Well, February is done now. This month I worked lots as I’ve been back at my old job on Feb. 22.

I’m still dealing with my employer about my missed monies of approximately 500 dollars.

It’s so frustrating.

This year I have more expenses such as RRSPs 100 dollars, Transit 30 dollars, Lottery 20 dollars and Vacation 20 dollars.

Last year I participated in the 2021 CBB contest, and I was 1 of 2 previous standing.

It was a great learning experience, although I have a love/hate relationship with my budget.

It’s been an emotional roller coaster; however, I feel like I have a handle on my budget now.

I have a clear goal to save money for my mortgage principal.

I also check my budget throughout the month, so I know where my money is going.

Budgeting is a discipline, and I will stick with it as there’s no going back.

Thanks for reading.

Feedback Mr.CBB

Congratulations on being one of the 2021 winners of the budget challenge. You worked very hard on your budget, and I can tell the impact of it just by what you say,

I think it’s great that you have added categories, whether new or not. Budgeting sure does get your mind thinking,

More or less, it’s about educating and pushing through the rough stuff through practicing.

Perhaps you want to see how one item in your budget performs over the year.

Keep at it.

Mr.CBB

Budget Challenger #2 – See Note

Not able to continue at this time, however she will be writing a blog post to share what is happening, why it’s happened and the outcome.

I’m looking forward to learning about her situation, and perhaps it may help other readers who are going through the same problem.

Budget Challenger #3

Hi everyone,

Well, it was a bit of an overspending month in February for us.

We had the chance to be kid-less three times this month, which hasn’t happened since the kids were born in 2017 & 2018.

With the pandemic, we have had the kids all to ourselves most of the time.

So, we went with it because we may or may not get this chance again.

We took advantage of that, which meant more dinners out and one day trip out of town.

There was also the last push to put in extra into our RRSP.

With our Dave Ramsey Zero Dollar app that came out to -257.03.

We also had a plumbing expense from one of our rentals, which accounts for that.

Also, as I’m sure everyone has noticed, the gas bill was almost double the previous month, and electrical was also up.

Feeback Mr.CBB

It has been a tough few years for everyone, but we’ll get through little by little.

Both Mrs. CBB and I talked about our utility bills last night, particularly our gas.

Our bill was 130. xx dollars is triple what it is during every other month but the winter months.

I feel Canadians will be as frugal as can be this year to catch up or keep up.

That’s the game’s name now, and whatever side is picked, the road will be bumpy.

It sounds like you’ve got a plan in place that works for you.

What areas of your budget would you like to improve? Ours is grocery, but now I’m thinking grocery and petrol.

Budget Challenger #4

Hello, CBB! Budget Challenger #4 here!

Mr. CBB indicated I should include more details, so I’ve tried to expand on my budget (and my struggles for the month).

Income

My Income includes cheques from work, insurance reimbursements, things I sell on the local marketplace, and any deposits from Projected Expenses accounts.

My only debt is the mortgage on my condo – I’m currently on an accelerated bi-weekly payment plan and put an extra $100.50 towards the principal for every payment.

Savings

My long-term savings is in my TFSA. I have a Defined Benefits Pension at work, and I maxed out my RSP in 2021 with the profits from selling my mobile home.

Until I get my taxes done, I don’t know my RSP contribution limit for 2022.

Projected Expenses

If people want to know the exact breakdown per Projected Expense category (i.e., how does the monthly $175 in Glasses/Health get broken down between glasses, CPAP mask, and prescriptions), I can break it down further.

Planned Expenses

“Planned” Expenses – I may rename this just “Expenses” going forward.

My budget format combines a Gail Vaz-Oxlade worksheet I’ve used for years and formulae from CBB’s budget.

This minimalist format works best for me – too much visual input overwhelms me.

This year I added the Category column to quickly break down spending and look at monthly/annual totals.

Here’s a snapshot of how I journal my money:

Any lines with a “B” were paid by Visa deducted from the balance.

I use my Visa wherever I can, pay it off in full at the end of the month, and accumulate RBC points to redeem TFSA vouchers.

In cases where purchases covered several categories, I have broken the bill down to identify them.

February, February, February

Compared to my last home, the first two electrical bills of the year were pretty high.

The previous owners averaged $130 a month, but I know there was a rate increase from the electrical company at some point in the last two years.

I’ve been waiting for details on an upcoming surgery, which has impacted my spending.

“Food” covers groceries and junk (fast) food, and I found myself reaching for convenience foods often.

I stockpiled food and litter to avoid lifting anything, so cat spending was up.

Weaving supplies, self-care and entertainment were unplanned, but they’re all the pre-surgery prep.

I made up the difference with money from the Cat and Self-Care accounts.

After surgery, I’ll have 6-8 weeks of recovery, much of which will be unpaid leave (I used up a LOT of leaves getting diagnosed).

I plan to apply for Medical E.I., withdraw as needed from my TFSA, and pause some projected expenses and TFSA contributions. But until I have my surgery date, I can’t firm up those plans.

After seven years of working on my finances, this is how that works for me.

My brain gremlins are happy with Projected Expenses but have never warmed to making “Emergency Fund” one of those accounts.

However, my net worth might dip occasionally, but it’s been steadily increasing overall, and I’m okay with that.

That’s February, folks!

Feedback Mr.CBB

I’m hoping March’s update comes to you from my recovery bed, full of honest accounts of medical spending. Cheers!

Excellent budget post. I feel as if you have everything you need under control.

As for the emergency savings, that’s up to you how you handle it. Do what makes you comfortable and safe.

Our net worth goes up and down, and that’s to be expected. I believe we are down $20k for February.

We need to remember that this will happen, and it’s for our future. I want to learn more about your RBC bank account and the TFSA vouchers.

P.S. Best of luck with your surgery.

Well done,

See you next month.

Budget Challenger #5

Hi everyone, the budget was a little rough this month, but I’m planning my first vacation since Covid, so that I may be going a bit overboard!

I was asked if I had an official budget in my last budget update. The answer is no.

My boyfriend and I have specific guidelines, more so spend what we want (within reason), and then if we get out of control the next month, we tighten the purse straps to make up for it.

It’s always worked, but with him not working right now and the price of food and gas rising exponentially, it may be something that we have to tighten up somewhat.

As mentioned, more money went out the door than I would have liked, but I still could put aside money into my RRSP ($250), and I have over $500 left.

The best thing I ever did was to pay off my mortgage.

I know I have a lot of potential bills coming up in the next few months for house repair maintenance, and my car is getting older, so who knows what will happen.

February roughly looked like this:

Transportation: 10%

Life: 46%

Savings: 37%

Debt: 0

Household: 10%

(Yes, I’m aware my percentages don’t add up, but it’s close, and I’ve never been good with math – I’ll have to set up the formula on my excel sheet to do this!)

Life was my biggest category. I ended up spending a lot more on vacation than planned.

I always book early and get good deals but booking three weeks before my trip meant paying much higher prices than I originally planned.

Also, I had assumed restrictions would keep me from travelling, but when it looked like I would be able to go, I decided to jump on it!

I’d love to know how people break down their budgets relating to travel costs.

I throw it generally under life, rather than having a separate travel section that breaks down food, gas, rentals, hotels, events etc.

Happy budgeting!

Feedback Mr.CBB

Reading this reminded me of how Mrs. CBB and I used to budget, and for us, it didn’t work.

There were so many missed opportunities to save money, and it wasn’t easy to see where the money was going.

Little did we know it was all small expenses that reduced our savings power.

We use a zero-based budget, but there is also a free Basic Budget you can print and use.

All you need is addition and subtraction to use it. If you want to use it, I can help you get it going.

Have fun on your holidays,

Mr.CBB

Budget Challenger #6

Hi everyone,

I am newly separated, so having our income cut in half will be a challenge. At home, I have three adult kids in their 20s, and we still have a mortgage after 20 years of owning the house.

This was due to my terrible decision to get a Line of Credit Mortgage with Manulife many years ago.

Moving forward, I then added $40,000 to it for basement renovations that, instead, we used for our three kids for sports expenses over about eight years (hotels, tournament fees, registration fees, GAS, etc.).

From 1996 to 2003, becoming a stay-at-home mom hurt us financially, which I can’t change now.

I now have more mortgage than we bought the house for in 2002!

Dumb! But I must move forward!

My husband moved out of the house, so I have the home expenses.

I didn’t do too bad in January, considering I was tight a few times but made it to the next pay.

I am trying to do right now to keep paying into most of my savings.

However, I cut the $500/month surplus going into my RRSP.

I still put about $150 into it as I did years ago, but I just wanted to get a feel for my budget.

I may add that into the budget later on a good note.

So I pay savings for property taxes, professional fees, auto, and vacation.

The vacation is flexible, but I try not to touch it if I can help it.

Also, I pay about $430/month into my Emergency Fund. I will try to keep this up since it’s important to pay yourself first!!

Any surplus I have the night before payday, I put it into a savings account or toward my Christmas debt (I know– I shouldn’t have done it, but it isn’t too bad!).

I also put money into a Christmas jar when I get spare cash on hand.

For February, I plan to pretend I am in isolation for a few weeks and use up more pantry and freezer foods.

I like to cook, so most of my meals are from scratch, which means less eating out.

So I will go to the store for fresh stuff I need and cut down on grocery bills.

Also, I have a trailer up north in Haliburton. So gas is going to be bad this summer.

I will try to save up so I have a bit of a surplus for gas, which will also be put into my vacation fund.

We will see how it goes!

Thanks for reading.

Feedback Mr.CBB

Hey, I’m glad you were able to send me your January budget moving into February.

As I mentioned, things happen in life and the fact that you finished your budget amazed me.

I’m sorry to hear of your marriage but happy that you are still able to get through financially at the moment.

I’m not a fan of using a line of credit or taking an equity loan from the house for many reasons.

One of them is what you are going through with your mortgage still being higher than what you bought it for 20 years ago.

I wish you luck, and keep the budget going and let us know how it goes.

We’re beside you all the way.

Take care,

M.R.CBB

The post How We Became Financially Educated: February Budget Update 2022 appeared first on Canadian Budget Binder.