What Are The Worst And Best Financial Decisions You’ve Ever Made?

Now is an optimal time to focus on making better financial decisions a priority especially if you are quarantined at home and looking for something to do.

Today, I have a financial education lesson I’d like you to participate in by writing your worst and best financial decisions.

With the state of our world right now it may be easier for all of us to see how much money we spent on the little things.

Why? Well, having to stay home means spending less money unless you are going bananas with online shopping and ordering skip the dishes 7 days a week.

For example, no more weekend entertainment at clubs or other events with friends saving you money.

If you spent $100 a week at the club and eating out you should be saving approximately $400 a month.

Even if you are getting funds from the government you should see some form of savings based on your previous spending habits.

That doesn’t necessarily mean you’ll have extra cash in your pocket, it could mean you won’t be adding to your debt.

The Worst Financial Mistakes Happen To Everyone

No matter how impressive a financial investor or saver you think you are you WILL make mistakes that you might regret.

What’s interesting about this is that we don’t often talk about the worst financial decisions because they are too embarrassing.

On the other hand, if something goes right nothing is stopping anyone from telling the world how happy they are.

There’s good and bad that come with both of these situations and that’s because life is about improvement by experience.

Camouflaging Bad Financial Decisions

Hiding bad financial decisions in your closet only means that you’re neglecting them.

Out of sight, out of mind doesn’t mean that the mess you’ve made will go away.

Perhaps you haven’t taken the time to understand where you went wrong and how to not make the same mistakes again.

Whatever the case may be I feel talking about the worst financial decisions I’ve ever made alarmingly soothing.

When you lose money to something you could have controlled it can weigh on you like a tonne of bricks.

Some people have no regrets and move on without initiating the process of understanding the dimensions involved with their errors.

Others pine over them like lost puppies looking for their mother to cuddle them and tell them everything will be alright.

Then there are people who want to take advantage of the data and experience to understand what they could have done differently. (Optimal)

You may fall into any of those three groups above and the reality of it all is that we will mess up from time to time.

Ideally, the fewer the mistakes the better and keeping the financial loss as minimal as possible.

Social Distancing By-law Officer Hands Out Fines

For example;

Party-goers in Quebec this week getting fines or more for not following proper social distancing protocols.

This is probably one of those worst financial decisions because now they have to pay a big fine.

Getting a fine for something we know we shouldn’t be doing is controllable.

Each of the seven individuals present at the house party received a fine of $1,546 for not complying with the social distancing measures implemented under public health orders.

- How will they learn from this mistake?

Hopefully, they will go home and stay home, learn from it and move on from this experience.

In the meantime, they’re out a big fat fine from a by-law officer decreasing savings or even worse putting them into debt.

Budgeting Is For Dummies

Another example of some of the worst financial decisions you might make is failing to properly budget your money.

I know I may be biased but I’m not selling you a budget I’m just stating the obvious.

By understanding the amount of money you have coming in (net income) and your debt to income ratio you can learn lots about your financial self.

Most people that contact me for financial assistance have never used a budget or started one and failed to use it.

Spending freely or believing money is under control sort of never works out for most people.

Whether you are applying for the Canadian Emergency Response Benefit (CERB) or not if you don’t have savings, let this be your warning.

I’ve read countless comments from people crying out that they can’t stay afloat financially as they have no emergency savings.

Saving money for a rainy day should be a priority and frankly, I consider that one of the worst financial decisions you’ve ever made if you haven’t started one.

Yes, adding $5 a week or even $2 a week is better than having nothing in your pocket.

Slash These Expenses To Save More Money

I credit anyone who slashes expenses wherever they can without complaining that they can’t do it.

Decisions in financial management are not easy however be determined to make it work.

- No eating out

- Nix the Netflix

- You don’t need data

- Kill the home phone

- Get rid of your cell phone

- You don’t need cable tv

- Save on groceries with coupons, coupon apps, reduced product, food bank

- Take the bus and get rid of your vehicle and insurance

- Sell your house and buy something smaller

- Find a cheaper apartment or move to an affordable city

- Sell what you don’t use in your house and stop collecting or buying crap you don’t need

- Find ways to earn cash or extra income online

- Buy used clothing instead of new clothing and make it last

- Stop going for unnecessary trips around the city wasting gas (plan for a day of appointments, shopping, etc.)

Honestly, this could go on and on trying to find ways to make changes to the way you spend your money.

I understand this is a case by case basis but for the most part, there’s always a way to line your pocket with a few extra dollars a month.

Related: How To Start Building Wealth In Your 20’s and 30’s

Financial Decision Making With Employee Group Pensions

One of the worst financial decisions I feel needs to be discussed is failing to participate in a group RRSP at work.

When an employer offers a pension it strikes a “feel good” chord for many people.

Where some people fail to invest in RRSPs outside of work having a group program is like a cherry on top of an employment offer.

This is the program where you put in the max amount allowed and your employer matches that.

Some people may say that it’s cheaper for an employer to offer a pension scheme than to offer a higher wage.

Whatever your opinion on this topic is just understand that money is involved and you should review it.

I think employers want their employees to save for retirement and one that shouldn’t be left on the table.

You Invest In Your Future Then We’ll Invest In It Too

Mrs. CBB said her previous employer offered to match up to 3% if the employee participated in the group program.

The money was put into a LIRA which is pensions funds in a Locked-In Retirement Fund.

Until she retires she is unable to remove the money from her LIRA which is what it’s for.

Although her LIRA is not worth much it’s thousands of dollars of money she could have missed out on

For those of you who don’t think it’s a good idea or you can’t find the money to invest, you’re walking away from free cash.

It’s as if I put a suitcase of money on the table and told you to bring me a suitcase of your money and you could walk away with both.

Obviously, with investments, most are long-term so you’ll have market volatility but the biggest risk is missing out on future retirement money.

Worst Financial Decisions You Might Have Made

Other bad financial decisions that might be hanging in your closet which could have been avoided.

You don’t have to check-off each one of these as this is a personal account of the worst financial decisions you’ve ever made.

This means have a seat and think about what you didn’t do so well at and begin writing each one down.

- Buying too big of a house with a little downpayment or Bought A House Too Soon

- Not investing in a Tax-Free Savings Account

- Failing to invest in a Registered Retirement Savings Plan

- Purchasing a luxury vehicle or perhaps leasing a vehicle

- Increasing Your Credit Limit

- Not paying back your Ontario Student Loans, personal loans or Debts

- Spending Money You Don’t Have

- Lending Money And Never Getting It Back

- Signing Up For Too Many Credit Cards

- Expensive weddings

- Investing big in Stocks with limited to no knowledge of what you are doing

- Too many expensive holidays on credit

- Buying a Time-Share and not using it

- No Life Insurance

- Moving Away For School when you could have stayed home

- Getting Bad Financial Advice and Losing Money

- Driving Without Vehicle Insurance (Pulled over and fined) (Accidents) (Death)

- Forgetting to purchase Tenant’s Insurance

- Failing To Make A Legal Will

- Did not save money when living with parents (rent-free or not)

- Drugs and Alcohol Use

- Quitting A Job You Loved To Be A Stay Home Parent or Moving To A New Job (Failed)

- Going To College Or University And Not Graduating Or Not Using Degree or Diploma

- Getting a Fixed-Rate Long-Term Mortgage

- Signed Up For Mortgage Insurance instead of Life Insurance

- Gambling

Now begin writing down your successful financial decisions.

The Worst Financial Decisions We’ve Made

In total, we’ve been married for almost 13 years now and we’ve made financial decisions that were less than desirable.

We’ve also grown up quite a bit since our teen years when we first started working and then went off to College and University.

This is not an exclusive list rather some of the most memorable worst financial decisions that pop into our minds.

- Not saving more money when we were younger

- Budgeting in our heads and not on paper

- Investing rather than having money sitting in the bank

- Using A Bad Real Estate Agent To Sell A House

- Spending too much money on groceries

- Hiring A Home Inspector

- Spent too much money on alcohol and entertainment

- Signed up for Columbia House Records

- Bought new instead of going to second-hand shops first

- Did not shop around for prices before making purchases

- Hiring a roofer who went bankrupt the next month (not calling references)

- Selling my UK house (could have rented it)

- Lending money we never got back

- Not investing in educating ourselves better on finance from a younger age (although, any time is better than never)

- Opened up too many credit cards for one-time store discount

- Not shopping around for car insurance rates

- Paying someone to do our income tax returns

Our Best Financial Decisions Over The Years

- Going Back To School

- Rented a room for $500/month until we saved over 20% of a downpayment and other fees

- Getting married low-key for $1000

- Bought a detached house using only one income

- Paid our mortgage off in 5 years

- Never accumulated any consumer debt on credit cards or with any type of loan other than a mortgage and OSAP

- Both started saving money from a young age

- Limited eating out

- Paid off student loans as fast as possible

- Cash only for used vehicles

- Buying Life Insurance

- Returning To School for Canadian Degree 2019

- Investing in our retirement savings early in our 20’s.

These are just a few of the best financial decisions we feel we’ve processed in our time together and before we got married.

Begin The Process Of Financial Healing By Claiming Your Failures and Successes

Getting out the negative financial decisions first will get your mind rolling

Once that is complete make notes and consider each situation and what you’ve learned from it.

Then, follow-up with the best financial decisions you’ve ever made.

This will be the feel-good part of the financial education lesson that you will participate in today.

At a time where you may be feeling low because you’re not earning as much money or perhaps your business isn’t doing well take the time to focus on experiences and successes.

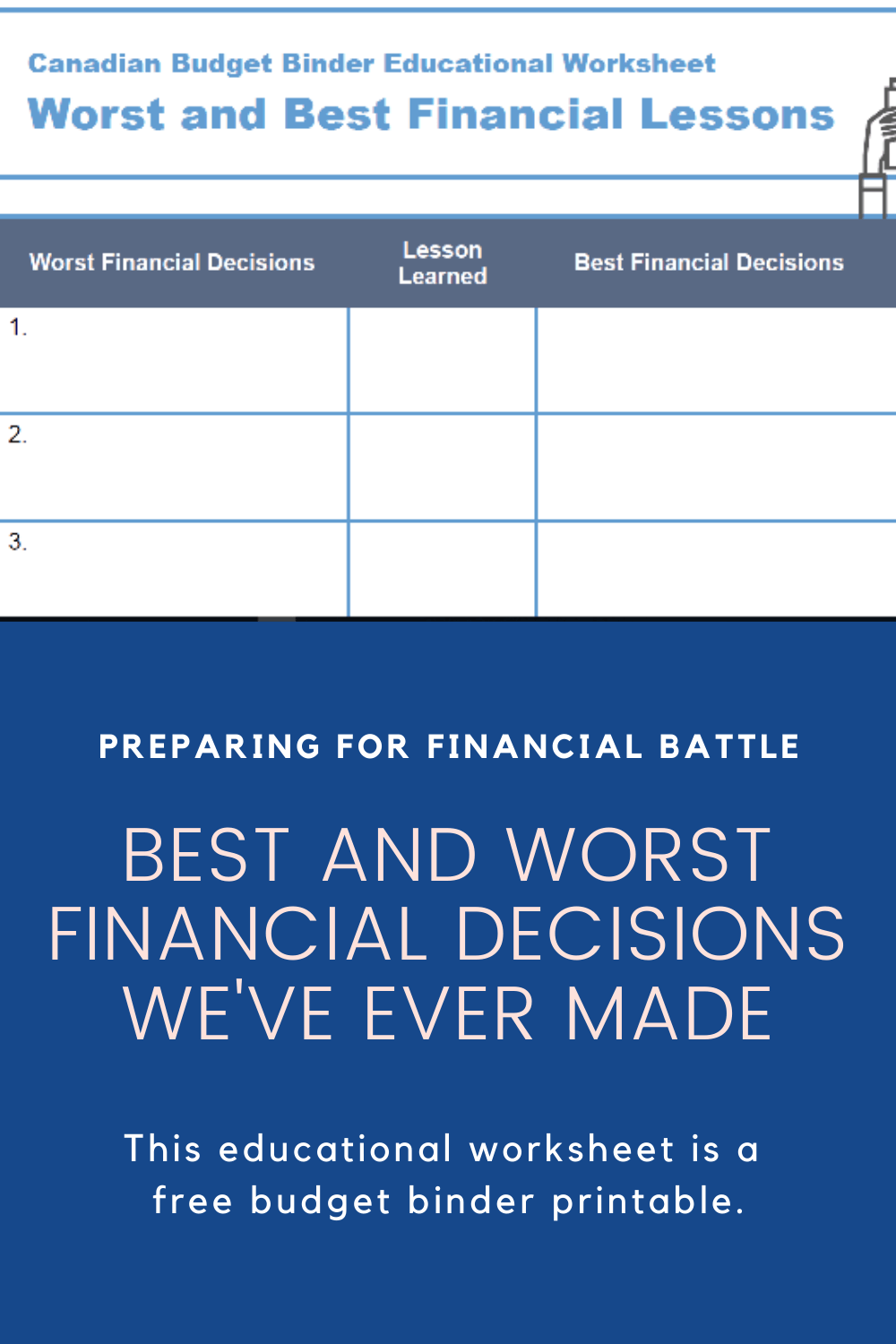

I’ve included a free printable educational worksheet lesson that you can add to your budget binder.

Mr.CBB

Discussion: Comment below with both the worst and best financial decisions you’ve ever made and tell me what you’ve learned from them. Now print the free worksheet and complete it.

Don’t forget to subscribe to my blog so you get my weekly posts and bi-weekly newsletter.

The post Best And Worst Financial Decisions We’ve Ever Made (Free Educational Worksheet) appeared first on Canadian Budget Binder.