How To Quit Buying Stuff As We Did To Become Debt Free

I’m sure you’ve told yourself that you must quit buying stuff you don’t need to save up money.

I know we have, many times and then we finally did something about it.

There are four things you need to consider in order to save up money.

First of all, to save up money means that you are;

- Spending less than you earn

- Using a budget to monitor your finances

- Finding ways to earn more money

- Mentally taking yourself away from spending uproar

To save up means that you are stashing money away to use for a need or to invest for the future.

For example, Monica needed to save up money to go on her holiday to Spain.

Why do we buy things we don’t need?

Well, it’s likely a mix of emotions which can be happiness and sadness to reach fulfilment.

When you want to save up money there is a process that needs to happen like clock-work and it involves budgeting.

Save Up By Avoiding Shoppers Remorse

I know that there are people who “stress spend” to fill a void in their lives and this kind of impulse shopping is dangerous.

I’m going to say that just about everyone has been in this position at one point in their lives.

Perhaps a relationship fails and you begin spending money to look and feel better and it gets out of control.

Maybe you’re addicted to grocery shopping and can’t pass up a deal which causes your grocery budget to explode.

Whatever the case may be behind your emotion shopping that causes shoppers remorse to take a step back before you swipe at the cashier.

Ask yourself, Do I really need to buy this or do I just want it?

Shopping just because you are sad or struggle with a shopping addiction is like eating a bucket of ice-cream and not sure why you did it.

The idea here is to balance your plate with a budget and to tighten the reigns so you aren’t spending crazy amounts of money when you should be saving.

What’s causing your void?

Often times writing out what you are feeling helps a person come up with goals.

Use your time doing things you enjoy instead of spending money that you don’t have.

It’s better to be involved with local clubs, groups or organizations or even learning something about a topic that interests you.

Spend Money On Stuff That Makes You Money

Saving up money is great but sometimes a faster way to build your bank account is to:

- Invest Your Money

- Buy and Resell Items

Investing your money for long-term retirement goals is a no-brainer especially the way costs for seniors are far beyond expensive.

When you get older having a savings account beyond emergency savings is critical to living your best retirement life and making sure your health needs are met.

Another way you can spend money to make money is to invest in something that gives you a return such as advertising for this blog or your business or buying and reselling items.

I’m sure there are many other ways to bulk up your savings and investments but I’m putting the idea out there that it’s possible and you should do it.

Donating is fantastic but if you are short on meeting financial goals consider selling what you can and using the money to pay for debt or invest in your future.

1. Save Up: Quit Buying Coffee

2. Quit Buying New Clothes

Have you ever felt like you needed to wear something new to work, events or gatherings each time?

The thought of anyone seeing you wear the same thing twice is not uncommon and an expensive mindset to carry.

Fashion trends and shopping for new clothes can eat up your clothing budget with one or two items.

What I always do before buying new clothes is to picture where I would wear the item.

This helps me decide whether it’s a piece that I can use in my wardrobe or it’s something that just looks good.

We quit buying new clothes many years ago and have opted to shop at second-hand stores exclusively.

In the event we can’t find what we need then we will buy brand new but it’s always used first, new second.

The savings are HUGE especially if you shop for used clothes on discount days.

A great tip is to shop ahead by season for used clothing as often times the clothing is cheaper.

3. Save Up: Quit Purchasing New Gadgets

Buying gadgets and home decor is the biggest waste of money when you don’t need it.

Mrs. CBB always used to say she could find a spot for something she’d buy or even get free.

Over the past 2 years, she’s been selling the stuff to save up even more money even though we are debt-free.

First of all, you probably don’t need the gadget or home decor you are buying because less is more.

Consider if that new clock to replace the old one is needed or whether you need the latest smartphone when yours works perfectly fine.

If you want to save up money then stop buying stuff you don’t need.

4. Save Up: Quit Buying New Vehicles

Buying a new vehicle means you’re purchasing something that depreciates the minute you drive it off the lot.

Opting for used or slightly used vehicles is the best route to go for your money especially if you have the cash upfront.

We purchased a 2017 showroom truck that had 5000kms on it for $46,000 everything included far less than MRP of $79,500 plus taxes etc.

Although we paid cash for the truck if you must get a loan find a vehicle that won’t make you go broke.

Consider the costs of repairs and if you don’t know call a mechanic and ask them for advice on the make and model you want to purchase.

5. Save Up: Quit Eating Out At Restaurants

One of the first cuts we made to our budget was eating out at restaurants.

Back when we started our budgeting journey just shortly after we married we ate out once in a while.

The problem was that we knew to make the food at home ourselves was far cheaper.

Besides, we hated leaving tips and that’s the honest truth.

It’s not because we don’t want to tip but we believe the owner should be paying employees a proper wage and get rid of tipping.

There’s no reason customers should be paying for restaurant food and the employee’s wage. Not a bad business if you ask me.

Now we have an entertainment budget and allowance that we can spend as needed where before we just went out to eat.

6. Quit Buying Baked Goods

7. Quit Buying Cheap Stuff

A big lesson we learned living a frugal lifestyle is that if you buy something that is cheap, you get what you pay for.

If you want to buy something that you’d like to have around for a long time it’s better to save for quality over the lowest possible price.

Just recently we bought a washer and dryer which I researched to death online.

The price was fairly high for both and I waited for a sale plus received the government grants along with rewards points.

I didn’t rush out to buy the set but waited for the right time.

If our machines were no longer working I’d head to the laundry mat until I found a price for a quality set that was with-in our budget.

Just because the price is less doesn’t mean you’ll get the life you want from an item.

8. Quit Buying Candles

Candles are a huge waste of money and something we used to buy quite often from stores like Zellers, Shoppers Drug Mart or shops in the mall.

To be fair we spent minimal money on a massive stockpile of Glade and Febreeze candles using coupons between 2010-2012.

Even though we spent small amounts of money after coupon we can safely say it was still a waste of money.

If you really need to burn candles consider going to a second-hand shop where they have loads of candles for pretty cheap.

What other ways can you light up your environment candle free?

9. Quit Buying Books

One of the worst purchases you can make is buying new books from book stores or online sites like Amazon.

Not only are you blowing money on something you might not ever read again but it’s going to be a dust collector.

Books are clutter in a house and unless you plan on reading it over and over its money wasted.

Visit your local library and see if you can take it out for free and then save up money you would have spent in your savings.

Perhaps the book you want to read is not at the library just yet, then wait for it.

Patience gets you further when you want to save up money than does wanting stuff now.

Optional cheaper ways to buy books is at second-hand shops, free from other people online and garage sales.

Summary

If you want to save up money and get your budget back on track so you can pay off debt than quit buying stuff you don’t need.

However, once you are debt-free you can start to introduce eating out at restaurants or buying coffee outside of the home.

Whatever choices you make will dictate how fast you save up and win this debt game once and for all.

Related: Debt Free Mom Shopoholic Comes Clean

Discussion: What have you quit buying to help you save up money?

Leave me your comments below as I’d love feedback on this post.

Love to you all,

Mr.CBB

Home Budget Income Report Feb 2020

Where did the money go?

You’re probably wondering why we had such a large expense in our Health and Beauty section aren’t you?

Well, you should talk to Mrs. CBB about that, haha!

She has been getting her body de-fuzzed, lol.

For years she has had issues with in-grown hairs but she has solved the problem by getting laser hair removal.

Yes, it is costly but we had to save up money before she could proceed.

Yes, it is painful but the results are amazing.

She no longer has to shave…and she loves it.

I’ll be doing a blog post all about the process, costs and outcome of her laser hair removal journey.

The rest of our month was pretty standard so we did a great job.

Next month we have another large expense so get ready for that surprise.

Don’t forget if you aren’t subscribed to the blog you won’t get my bi-weekly email newsletter with behind the scenes at the CBB house and Blog. Plus exclusive contests.

Sign up today!!

Have a great budgeting month everyone.

Home Budget Percentages

Our savings of 32.76% includes investments as well as any savings for this month based on the net income of $9307.37.

We save up money in our projected expenses for things that need to be paid for in the coming months.

All of the categories took 100% of our income which shows that we accounted for all of the income in February 2020.

This type of budget is a zero-based budget where all of the money has a home.

Monthly Home Budget Expenses

Below is a breakdown of our expenses which helps us to understand where all of our money goes.

- Chequing– This is the bank account where all of our debt gets paid from. We use Simplii Financial.

- Emergency Savings Account– This is a high-interest savings account.

- Regular Savings Account– This is a savings account that holds our projected expenses.

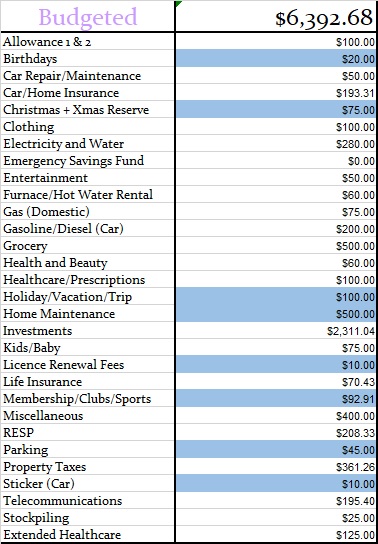

- Monthly Budgeted Total: $6,392.68

- Monthly Net Income Total: $9307.37

- (Check out our Ultimate Grocery Guide to see where our grocery money goes)

- Projected Expenses: These are expenses we know we will pay for throughout the year = $852.91

- Total Expenses Paid Out: $7924.90

-

Total Expenses Actually Paid Out: Calculated is $9307.68 (total net monthly income) – $852.91 (projected expenses) –$7924.90 (savings to emergency fund) = $529.56

- Actual Cash Savings going into Emergency Savings: Calculated is $9307.37 (total monthly net income) – $7924.90 (actual expenses paid out for the month) – $852.91 (projected expenses) = $52956

Monthly Budget and Actual Budget

Below you will see two tables, one is our monthly budget and the other is our actual budget.

This budget represents 2 adults and a pre-schooler, plus retirement investments.

Budget colour chart: If highlighted in blue that means it is a projected expense.

Since May 2014 we’ve been mortgage-free so much of our money will be directed at savings, investments, and renovations.

I appreciate that you enjoy this budget update each month but I do hope you view this as an educational tool rather than comparing your financial numbers as our situations are all unique.

Spending less than we earn and budgeting has been the easiest way for us to pay down debt and save money.

Monthly Home Budget Actual Expenses

CBB Home Budget Updates Month By Month

Just in case you missed our budget updates from 2012- present I’ve compiled them all on one handy page: monthly budgets.

2020 Home Budget Challenge

First off, congratulations to the wonderful people below for taking on the 2020 CBB Budget Challenge.

It’s not easy to commit to something like this and as I learned last year many people initially want to join in December but drop out quickly.

I’m not sure what that is perhaps it’s the December financial blues kicks in or they easily give up on themselves.

Either way budget reports are extremely important to your financial success so I applaud you for taking the time to create them.

February Update: Unfortunately as I expected we had challengers drop out and we are left with two. I’m sad but at the same time, it just confirms that finances are on the back burner in many people’s lives.

Budget Challenger #1

WHAT HAPPENED THIS MONTH

February was a relatively quiet month for us since I pushed back our Family Day Weekend get-away until the fall.

I am having a dickens of a time trying to get caught up on the corporate accounting in between all the tax accounting and my poor health.

I decided to keep my head down and keep plugging my way thru the paperwork.

We had another batch of Canada Premium Bonds mature on Feb 1st and I have reinvested the maturing funds into money market mutual funds until we get all the little dribs and drabs gathered up.

There is a slew of little maturities to come before December 2021.

I am treating the mutual funds as a temporary interest-bearing receptacle for them all.

Our 2020 Speculation and Vacancy Tax Declaration forms for the Province of British Columbia arrived in the mail on Feb 4th and I e-filed our declarations…another task I can tick off my “To-Do List” for another year.

Our home is our primary residence all year long…therefore the Speculation and Vacancy Tax does not apply to us.

Thank God! Property taxes are high enough as it is without adding additional taxes!

Spring must be around the corner because I have started getting phone calls again from real estate agents wondering if we are interested in selling.

Nope, we aren’t budging at least until hubby has retired and possibly not even then.

He’s only a 30-minute walk to work or better still he’s a 15-minute bike ride away, why would we move?

I sent our annual RRSP and TFSA fees to our brokers.

I also made our TFSA contributions for 2020 and have invested those funds.

As far as the TFSA’s go, the only thing left to do this year is reinvested the five maturities that occur during 2020.

I won’t mail our 2020 RRSP contributions nor the cash top-ups for our non-registered brokerage accounts until after the 2019 income tax returns have been prepared.

Also, I have the EXACT 2020 maximum RRSP contribution figures for both hubby and myself.

This year there will be two “top-up periods” on our non-registered investments.

In August we will top up the funds at TD Waterhouse (the account that hubby and I created together) and in November we will top up our RBC Dominion Securities account (where we stashed hubby’s inheritance money from his mother).

NEW THIS YEAR

We have and will continue to cut back considerably on our grocery shopping this year.

We are choosing to eat from the pantry, fridges and freezer before we buy anything new.

We are very well stocked so I expect this will make a huge dent in what we spend on groceries this year.

With the prices skyrocketing we’ll restrict our spending to fresh items only that round out and spruce up the food we already have on hand. So far…so good.

I have a maximum grocery budget of $180 per month so if I can reduce what we spend to $80 per month that will give us $1,200 at the end of the year that can be used to celebrate our holiday season, my 65th birthday and anything else that hubby might need or want. Think I can do it?

Hubby says I rule over our budget like a dictator with an iron fist! Yikes! Henry VIII had nothing on me! I would have no hesitation declaring, “Off with their heads!”, if you have mucked with my budget! LOL

If I can succeed at this grocery shopping “STRETCH AND SAVE EXERCISE”, I plan to give hubby the money and let him have it to use as he wishes for our holiday season or whatever else he likes.

I think he’ll love being able to spoil us without having to worry about the cost of a change.

I know he’d love to be able to plan something special for my 65th birthday without letting me see the bill.

We also have my father’s 90th birthday coming this December and at least one sister has some pretty grandiose, megabucks ideas on what we should do for him.

Much as I love my Dad, dropping more money than I can afford is not going to do anything except put us in the poor house.

I was sharing with a friend this morning that my Mom taught me that everyone needs to be a hero once in a while and she worked hard to make sure that each of us got our moment to shine.

She didn’t work outside the home after the children started arriving but she had a “household budget” to run the home and handle the needs of the kids…including those moments to shine.

She was an absolute rock star at budgeting and saving!

Every penny, nickel, dime and quarter that she saved by shopping sales, clipping coupons, making frugal meals, etc went into her envelope for “her money” that she later invested in Canada Savings Bonds.

By the time I was 18, she had amassed $25,000 in bonds from all the scrimping and saving.

Also, in her purse were envelopes for the house and each of the children.

Just because we didn’t need something today didn’t mean she wasn’t saving her heart out for the day when we did.

There’s nothing quite like a mother’s love and sacrifices!

OUR “STRETCH AND SAVE “ GROCERY SAVINGS:

Neatly tucked away we now have $200.00 towards the $1,200.00 goal that I have set to be able to give my hubby.

I can’t tell you how exciting this is for me.

I could just cry thinking about how much this will mean to him, not to mention how shocked he will be!

So, shhh…nobody tells him ok?

HOW ARE WE DOING WITH OUR CREDIT CARDS?

First of all, let me say that I do not carry cash…not more than $20 at any given time.

As a result, we use credit cards for all of our purchases and in the process collect points, earn cashback and keep our various reward points and credit cards active.

We also do not use debit cards for point of sale transactions because they are far too vulnerable to hackers.

I must stress that I do not recommend this practice though unless you are certain that you can pay your balances in full ALWAYS.

I have a really firm handle on exactly what we have in the bank at any given moment and we never spend anything on a credit card unless we already have the money sitting in the bank to cover that purchase.

That doesn’t mean the next payday either…it means we have the money NOW!

My PLATINUM AIR MILES AMEX

For February we continued to use my PLATINUM AIR MILES AMEX wherever we could.

We closed out January with 532 of the 1,000 miles that we need to retain our Gold status and dum de da dum….FEBRUARY’s closing balance is 943!

So, it’s time for Larry to resume using his Marriott Bonvoy AMEX card while I continue to use my Air Miles AMEX until we hit the 1,000 air mile mark.

The credit card balance is $0.00

Hubby’s MBNA Alaska Airlines MasterCard

Hubby used his MBNA Alaska Airlines MasterCard in January so now the card is at the back of his wallet and will be used only at COSTCO Canada if he shops or gets gas there.

I deal with our insurance broker in November and just charge the home insurance renewal to my supplementary card on his account.

The credit card balance is $0.00

My MBNA Alaska Airlines MasterCard

I used my MBNA Alaska Airlines MasterCard this month to pay our storage locker fees for the next six months.

The only other time that I will use my MasterCard this year will be to pay our travel health insurance in November when we go into our local BCAA office to renew our policies.

The credit card balance is $0.00

Hubby’s SCOTIALINE Personal Line of Credit VISA

Hubby has this card but doesn’t use it. He just keeps it so that he has an AMEX, MasterCard, and Visa for which he is the primary cardholder.

The closing credit card balance for the month is $0.00

My SCOTIABANK VISA

This month wherever a vendor did not accept AMEX we used our Visa cards and are slowly increasing the amount of cash we are due to get back in November.

Our CASHBACK BALANCE is currently $20.26

The closing credit card balance for the month is $0.00

Hubby’s MARRIOTT BONVOY AMEX

No charges have been made to hubby’s card so far this year but, since we have now almost reached our air miles requirement for the year, he will resume using this card to collect Marriott points for future travel.

What I did though was purchase 50,000 Marriott points for deposit to his account.

It keeps his account active and since I used my Marriott Bonvoy AMEX card to pay for the purchase, I will get points too and that will keep my account active as well! It was my Happy Valentine’s Day present for my sweetie.

I buy him 50,000 points every year so that by the time I have earned my LIFETIME PLATINUM STATUS (8 more years to go including 2020) and we start working on upgrading his status from Gold to Platinum, he’ll have points to cover at least some of the necessary reservations.

Talk about killing two birds with one stone, huh?

The outstanding credit card balance is $0.00

My MARRIOTT BONVOY AMEX

I had some online purchases in January using my MARRIOTT BONVOY AMEX (an e-book and an Amazon gift that I shipped directly to a friend).

I had one online grocery charge to this account in February along with the Marriott points purchase that I did for my hubby.

I am hoping that I will resume using this card full time in April.

The closing credit card balance is $0.00

I am sure you wonder why we have so many credit cards. I work hard to keep both of our credit ratings high so that one day when one of us passes…the other will not be left without an AMEX, MasterCard, and Visa in their name and with a well-documented credit history.

I hear so many stories where the husband was the “breadwinner” of the family and had all the credit cards in his name granting supplementary card access to his stay-at-home wife.

Hubby passes away & suddenly she can’t get a credit card in her name even though she has handled the payment of their household bills for years. Don’t let that happen to you!

We each need to build and maintain our credit histories!

OUR VACATION STATUS

This month we saved another $252.25 towards our vacation expenses and including the interest that we earned on the high-interest savings accounts…we finished off the month of FEBRUARY with $4,388.06 available for our 2020/2021 holiday enjoyment.

I also have a TRAVEL GIC that will come due in early 2021 that I keep re-investing for the day when hubby eventually retires and we can plan a nice long trip! It’s going to fund his Happy Retirement Trip!

Every time the GIC matures I add whatever I can before I re-invest the principal, interest & any new money I can scrape up so that it keeps growing at a reasonable rate and will hopefully be enough to cover his dream vacation.

The 2020 Holiday Itinerary:

- Jan Overnight Get-away – $150.00

- $0.00 SPENT – POSTPONED TO MARCH

- Family Day Weekend – $250.00

- $0.00 SPENT – POSTPONED TO SEPTEMBER

- March Overnight Get-away – $150.00

- Easter – $350.00

- Victoria Day weekend – $250.00

- Canada Day BBQ – $100.00

- July Overnight Get-Away – $150.00

- BC Day Weekend – $250.00

- Labor Day & Hubby’s Birthday – $925.00

- Canadian Thanksgiving – $450.00

- American Thanksgiving & Holiday Treats – $300.00

- My 65th Birthday Adventure

- Christmas – No Reserve this year

- re “Grocery Stretch and Save”

WHAT I LEARNED THIS MONTH:

Not a darned thing. I had my head down working like a crazy person on accounting and tax matters so I haven’t had time to worry about anything except putting one foot in front of the other and sticking to our budget.

Maybe that’s the thing to take away from this month…when life is hectic, it’s important to stick to the budget so that exhaustion and distraction don’t lead you astray and onto a path towards financial destruction.

It’s would be extremely easy for me to get lazy and think about getting take-out for supper. Let’s face it…I am human.

Even easier, and much cheaper, is to simply open a can of soup or beans/lentils and serve the main with either a couple of nice buns, a side salad, raw veggies & dip or even a slaw.

Cheaper is good, but more important is my ability to exercise portion control & having the ability to provide a healthier meal than fast food.

That’s all for February. See you next month!

Budget Challenger #2

So February had some definite good and bad points! I was on vacation the first week of February and everything had been paid before leaving except Uber and food.

Unfortunately the day I tried to fly home was the ice storm so I got stranded for 2 days.

I had travel insurance but it sucked because everything was out of pocket and I’m still waiting on getting that money back.

But, the positive side is that I couldn’t spend money the rest of the month because I had given my visa such a workout from those extra days in Miami.

Housing – $67

Transportation – $438

Short Term Savings – 300

Life – $1671 (would have been $750 less if I didn’t have to pay for additional days in Miami) plus I got billed $90 for a subscription box I thought I had cancelled.

The remainder of my paycheque went into long-term savings.

Pros In February:

Less spending because I was on vacation and broke when I got home, and I cancelled an online service I paid for, it doesn’t save me much but will save me $10 a month.

Cons In February:

I had so much extra spending done in 2 days.

During the process, I learned a lot from this about how to handle the situation, but it cost me a lot of money I wasn’t expecting to pay.

Also, I got billed for something I’m positive I cancelled last year (a subscription box).

The company has terrible customer service, so I went in and cancelled again.

If I get billed once more I will change my credit card number rather than trying to keep messing with them.

See you in March!

The post 9 Things We Quit Buying To Save Up Money : February 2020 Budget Update appeared first on Canadian Budget Binder.