Every technology evolves. The first blockchain produced Bitcoin as deflationary gold, a store of value. The second type of blockchain produced smart contracts in the form of Ethereum, building the foundation for decentralized finance.

Both use a Proof-of-Work (PoW) consensus mechanism to verify transactions across network nodes. The latest, third-generation blockchains are moving away from PoW to Proof-of-Stake (PoS). Instead of using mining as an energy-intensive consensus, PoS blockchains use staking.

But, what is staking, and how does it work?

Consensus—Blockchain’s Backbone

To fully grasp what staking is, you must first understand why blockchains depend on consensus. As you may already know, blockchain is a distributed digital ledger across a network of computers. Each computer of that network, called a node, holds the record of the entire ledger.

Therefore, if one node goes down or is attacked, the ledger is accessed or compared against other nodes. The manner in which a ledger is verified across nodes is called consensus. As the name implies, these algorithms check all peers on the network to determine the ledger's true state—be they cryptocurrencies or smart contracts.

It then logically follows that consensus (as in, general agreement between nodes as to the network status) gives blockchain its reputation as an unassailable, decentralized, and trustless network. Accordingly, when a transaction is conducted, i.e., a new block added, all the users can rest assured that the new state of the blockchain is true.

How Does Staking Work?

After Elon Musk tweeted that Tesla had canceled its Bitcoin payment option, the crypto market suffered a 40% collapse. This happened not because of the cancellation itself, but because Musk framed Bitcoin as not eco-friendly enough.

Related: The Most Environmentally Friendly Bitcoin Alternatives

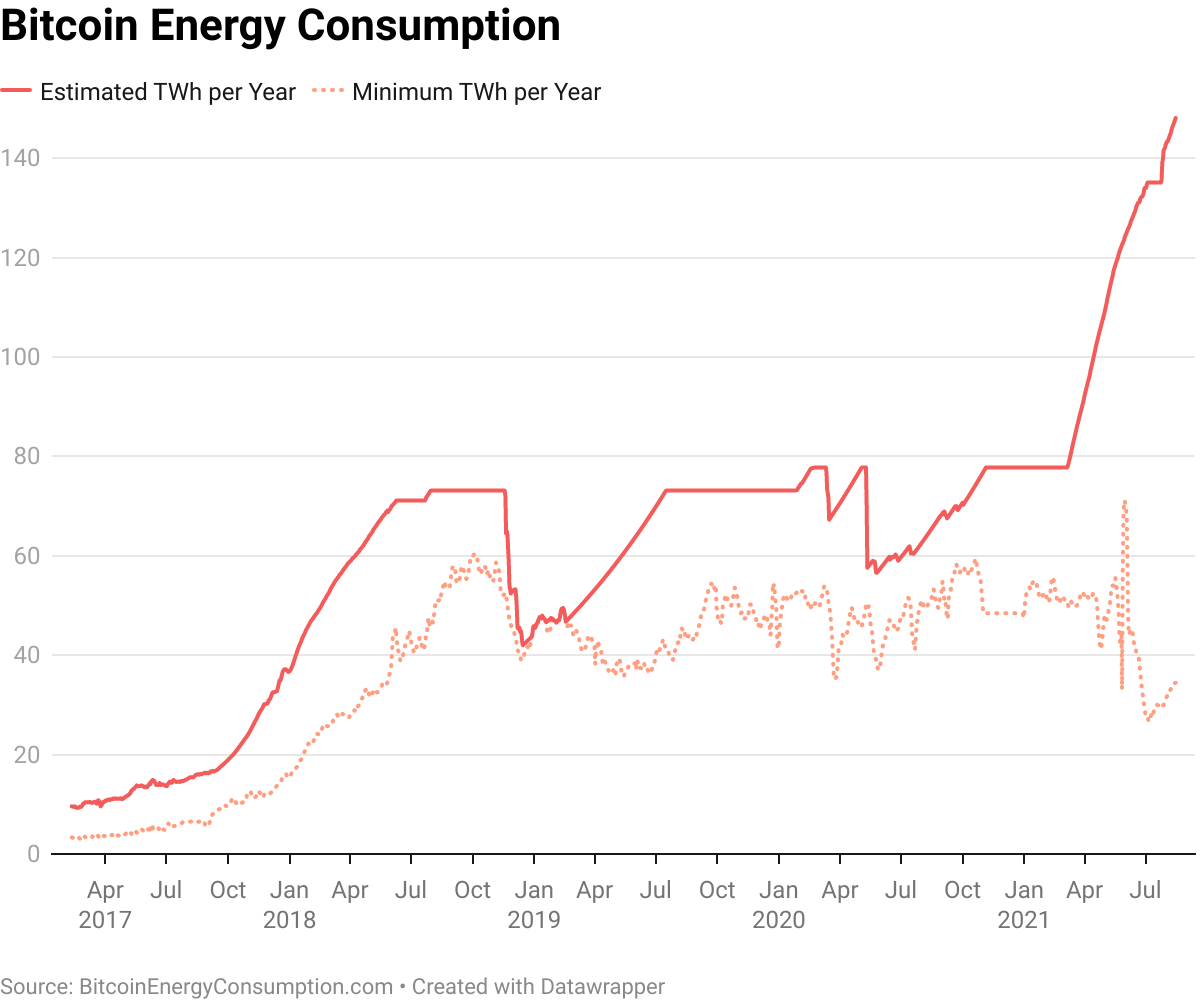

Because Bitcoin uses Proof-of-Work consensus to verify transactions and add new blocks, it is quite energy-intensive. The work needs computational power for a node to solve a math puzzle. As a result, those who verify a PoW network must invest in expensive hardware that uses quite a lot of electricity.

In contrast, Proof-of-Stake (PoS) blockchains such as Ethereum, Solana, Polkadot, Algorand, and Cardano use validators instead of miners. Validators become guardians of the network by staking a certain amount of the blockchain's native cryptocurrency. In other words, they lock in crypto assets, which are then used to validate blockchain transactions.

Does Crypto Staking Earn a Reward?

Depending on the number of assets locked in (staked), validators receive rewards. Of course, validators are not actual people but computers that are running validator software. It also contains the entire copy of the blockchain.

Whenever a user submits a transaction, like buying an NFT, a validator adds the transaction to the blockchain. Ethereum is yet to transition into PoS fully, but it already has staking, at a minimum level of 32 ETH, for one’s computer to qualify. Presently, Ethereum is the most decentralized network with 233,734 validators who have staked about 7.2 million ETH worth $24.3 billion.

Other PoS blockchains have different staking thresholds, but Ethereum holds by far the largest market share as a smart contract platform.

As you can tell, crypto staking is a passive activity. The staker locks their coins in a wallet, which are then used to add new blockchain blocks, i.e., transactions. The larger the staked holdings, the more likely the stake will be used to validate the blocks.

Staking on Crypto Exchanges

There is another form of staking that can also be used as a source of income. The biggest exchanges, Binance and Coinbase, both provide rewards for staking crypto assets. For example, on Coinbase, you can earn up to 5% APR (annual percentage rate) on ETH staking by locking funds in your crypto wallet to the exchange.

Meanwhile, Binance has up to 20% APY (annual percentage yield) on ETH 2.0. The difference between APR and APY is that the former doesn’t account for compounding interest. Both exchanges make it possible to stake ETH if you have minimal balance. Then, they connect to the blockchain protocols to earn rewards.

Not many people have 32 ETH ($108k) at hand to become Ethereum validators, so this is the next best solution for passive income with the lowest risk possible. Speaking of which, validators who stake their coins can be punished if they fail to validate blocks or engage in malicious behavior. Then, their locked-in crypto holdings are slashed as a punitive measure.

Is There a Way to Increase Staking Rewards?

As noted, the likelihood of staked assets being used for validation is proportional to their size. Correspondingly, a group of stakers can create a staking pool to accumulate their holdings. This increases their chance to be frequently used to validate blockchain blocks.

Likewise, this also increases the reward frequency. Lido is one of the most popular ETH staking pools. However, one has to be prepared to lock in their crypto assets for a fixed period of time. There are other stipulations depending on each staking pool.

Nonetheless, staking pools provide the most expedient way to proportionally share rewards without having a fortune to stake. Additionally, platforms like Staked, MyContainer, and Stake Capital have specialized in offering staking-as-a-service (SaaS).

What Other Cryptos Can Be Staked?

Alongside Ethereum (ETH), one could also stake Cardano (ADA), Solana (SOL), Polygon (MATIC), Algorand (ALGO), Kusama (KSM), Zilliqa (ZIL), and Polkadot (DOT). Each has its own upper APY staking range percentage, so it’s well worth considering.

Solana, in particular, has managed to outperform Ethereum by 500% in the last three months, largely thanks to increased NFT sales and Solana’s cutting-edge speed, scalability, and combining PoS with Proof-of-History (PoH).

While many consider Bitcoin as a better alternative to gold, as an inflation hedge, you will find that these emerging blockchain products have a better chance to have 2X or 10X yield within a year (not investment advice, do not invest more than you can afford to lose!).

Lastly, these networks pay staking rewards depending on the current rate of inflation, alongside validator uptime and commission. Given the fact that traditional banking saving accounts offer near-zero APY, it is well-worth researching PoS networks to figure out the optimal staking model.