Editor’s note: This article is part of a weekly column to answer your credit card questions. If you would like to ask us a question, tweet us at @thepointsguy, message us on Facebook or email us at tips@thepointsguy.com.

While the 2021 tax season is officially behind us, there are important things to keep in mind for any tax season — no matter what year it is.

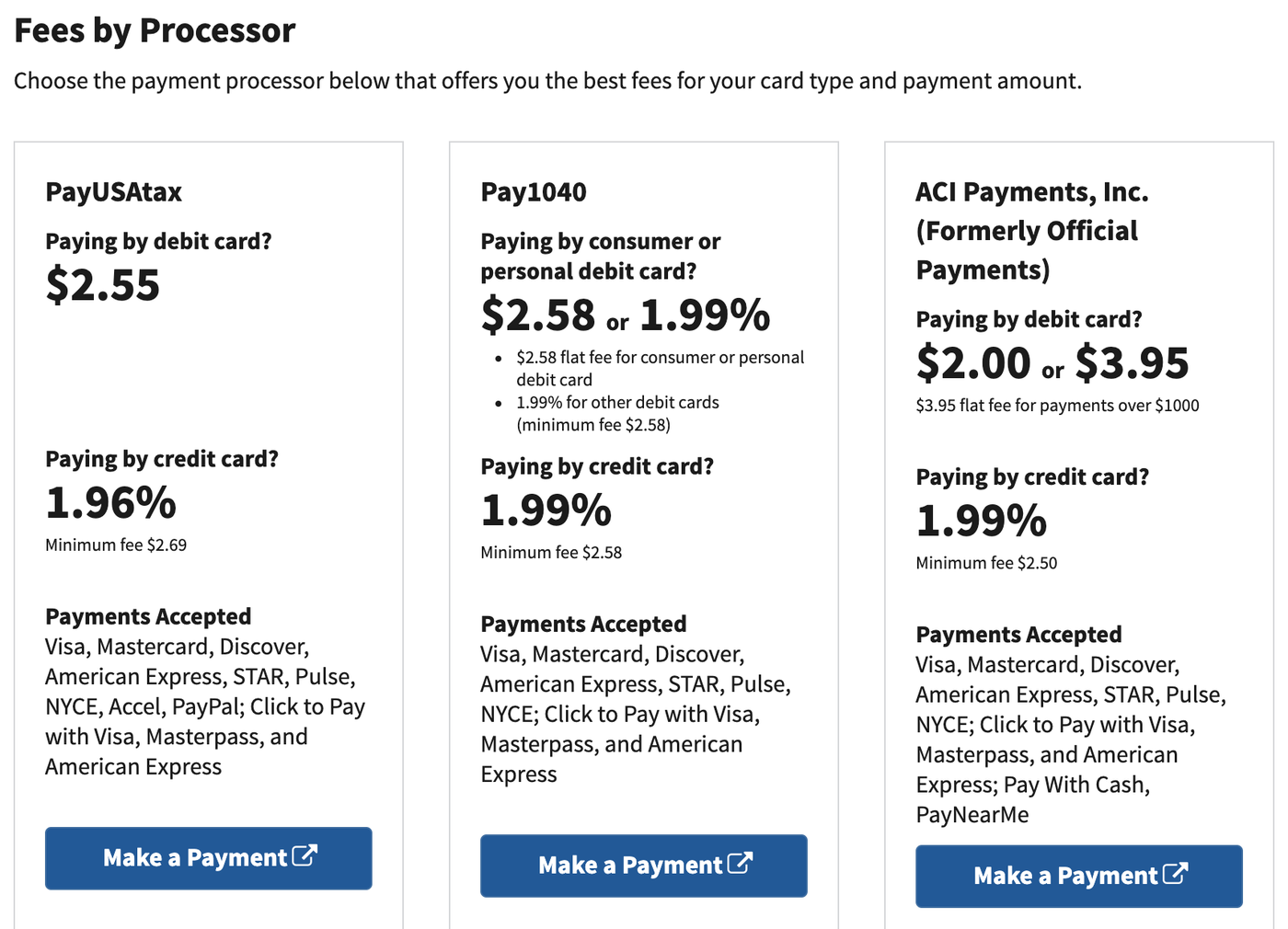

First, did you know you have the ability to pay your taxes with a credit card? The Internal Revenue Services (IRS) works with three approved payment processors to allow credit card transactions. However, at a minimum, you’ll pay a convenience charge of 1.96%.

In some cases, this additional fee is worth it. Some cards offer more than 1.96% in cash back or rewards points, according to TPG valuations. TPG reader Mark Copella wants to know how tax payments are processed — and whether they show as cash advances or a normal transaction.

In the future, I know I want to use my card to pay for taxes. It makes sense for me even with the fees. However, how can I confirm that my card counts tax payments as purchases that get cash back applied? In other words, will it count as a cash advance?

First, a cash advance is a feature that allows you to withdraw some portion of your credit line as cash. However, they typically incur high transaction fees and high-interest rates. Plus, cash advances don’t count as qualifying purchases so you won’t earn rewards.

To mitigate the risk of accidentally triggering a cash advance, try reducing the cash advance limit allowed on your card. Many card issuers will allow you to set it all the way to zero, so any transaction that codes as a cash advance will simply be declined.

But for Mark, the good news is that paying taxes with your credit card is not considered a cash advance. That means you’ll earn rewards on that payment.

Related: Chase has updated its definition of cash-like transactions: Here’s what you need to know

For instance, PayUSATax, the credit card payment processor that charges the smallest transaction fee (1.96%) to pay your taxes with a credit card, clearly states on their website that your tax payment is not considered a cash advance.

The convenience fee is charged by Value Payment Systems, LLC to cover the cost of processing the transaction. Fees are based on the amount of the payment or payment method and are shown after selecting your payment method. Your tax payment will be treated as a retail purchase and not a cash advance purchase.

If it makes sense for you, you can pay your taxes with a credit card — and you’ll earn rewards in the process. Remember just to do the math to determine if it’s worth it, considering the minimum 1.96% transaction fee on the total amount owed.

Related: Paying taxes with your credit card in 2021

Featured photo by kitzcorner/Shutterstock.