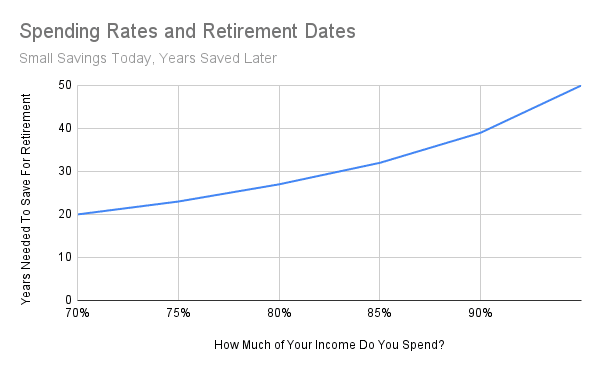

Retirement math can be complex. Investment returns, Social Security, spending rates, etc. But we’re keeping it simple today. We’re going to cover a basic concept that will allow you to retire decades early.

Imagine a married couple with the following statistics:

- They earn $100,000 per year in 2023 dollars.

- Every dollar is either spent or saved.

- Saved dollars are invested. They grow at 7% per year over many decades.

- Rather than use the famous 4% rule to determine when they can retire, we’ll use a more conservative “3.33% Rule.” That means our couple must save 30x their annual spending to comfortably retire. We’ll come back to this idea later.

- By the time they retire, they’ll receive $2400 per month in Social Security (measured in 2023 dollars). This is a big boost to their retirement income needs.

What do they spend? What do they save? That’s what we’re looking at today. The importance of their spending-to-saving ratio cannot be overemphasized!

First, imagine the couple spends $95,000 and saves $5,000. This includes taxes, groceries, their mortgage, all of it. At this savings rate, the couple will need 50 years to build up their retirement nest egg.

I’m going to argue with myself here. By the time 50 years elapses, this couple will be close to death. If you’re going to retire at age 80, you don’t need 30 years of spending in your nest egg. By Year 40, they’ll have saved 15 years of spending. By Year 44, they’ll have saved 20 years of spending. A more realistic retirement date is somewhere in that range. But we’re still talking 40 to 50 years before retirement is realistic.

Let’s tweak the couple’s spending habits. Rather than spend 95% of the income, let’s dial it back to 90%. Instead of spending $7900 per month, they’re only spending $7500, and they’re investing the $400 difference.

This simple tweak shaves 8 to 11 years off their expected retirement date. They’ll meet their full retirement number in Year 39. Depending on how old that makes them, they’ll potentially hit a more realistic retirement number around Year 35.

Let’s keep going. We can dial back the spending to 85%, 80%, etc. Each 5% increment represents ~$400 of additional savings per month.

- Spending 85%, Saving 15% – full retirement by Year 32

- Spending 80%, Saving 20% – full retirement by Year 27

- Spending 75%, Saving 25% – full retirement by Year 23

- Spending 70%, Saving 30% – full retirement by Year 20

Our first hypothetical couple spends 95% of their income or $7900 per month. They hit full retirement in 50 years.

Our final couple spends 70% of their income or $5800 per month. They hit full retirement in 20 years. (Granted, 20 years of savings might not be enough time to get them to Social Security age!). They really can retire decades early.

A 25% difference in spending/saving leads to a 250% difference in retirement dates. 30 years difference! It’s not magic, nor does it involve top-secret investing knowledge. Instead, the underlying mathematical reason is compound interest. A small savings difference early in life compounds into a huge retirement difference later on.

Compound interest is something that everyone can harness. Everyone.

And every small percentage point counts. If you don’t save much (like our 95% spenders), every percent you save will buy you two full years of earlier retirement.

If you’re already a mega-saver (like our 70% spenders), you’ll need 2% additional savings to buy another year of early retirement.

I know saving isn’t easy. We have bills to pay and mouths to feed and there’s nothing in the world for free. Saving is hard. But it’s possible.

What’s not possible is getting back decades of time.

I enjoy working and don’t see retirement as a panacea. I’m not racing to retire decades early. But I don’t want to work until I’m 75, either.

A small change today might buy us a world of flexibility later on. That’s a trade in our best interest.

—

Thank you for reading! If you enjoyed this article, join 6000+ subscribers who read my 2-minute weekly email, where I send you links to the smartest financial content I find online every week.

—

This post was previously published on The Best Interest.

***

You may also like these posts on The Good Men Project:

Escape the Act Like a Man Box Escape the Act Like a Man Box |

What We Talk About When We Talk About Men What We Talk About When We Talk About Men |

Why I Don’t Want to Talk About Race Why I Don’t Want to Talk About Race |

The First Myth of the Patriarchy: The Acorn on the Pillow The First Myth of the Patriarchy: The Acorn on the Pillow |

Join The Good Men Project as a Premium Member today.

All Premium Members get to view The Good Men Project with NO ADS.

A $50 annual membership gives you an all access pass. You can be a part of every call, group, class and community.

A $25 annual membership gives you access to one class, one Social Interest group and our online communities.

A $12 annual membership gives you access to our Friday calls with the publisher, our online community.

Register New Account

Log in if you wish to renew an existing subscription.

Need more info? A complete list of benefits is here.

—

Photo credit: iStock

The post How to Retire Decades Early appeared first on The Good Men Project.