The Chase Freedom Flex just got a lot more rewarding.

Chase has just launched a new promotion that allows cardholders to earn 5% cash back on your top spending category this quarter, on up to the first $1,500 spent. If you’re familiar with this card’s earning rate, the lightbulb may start to go off …

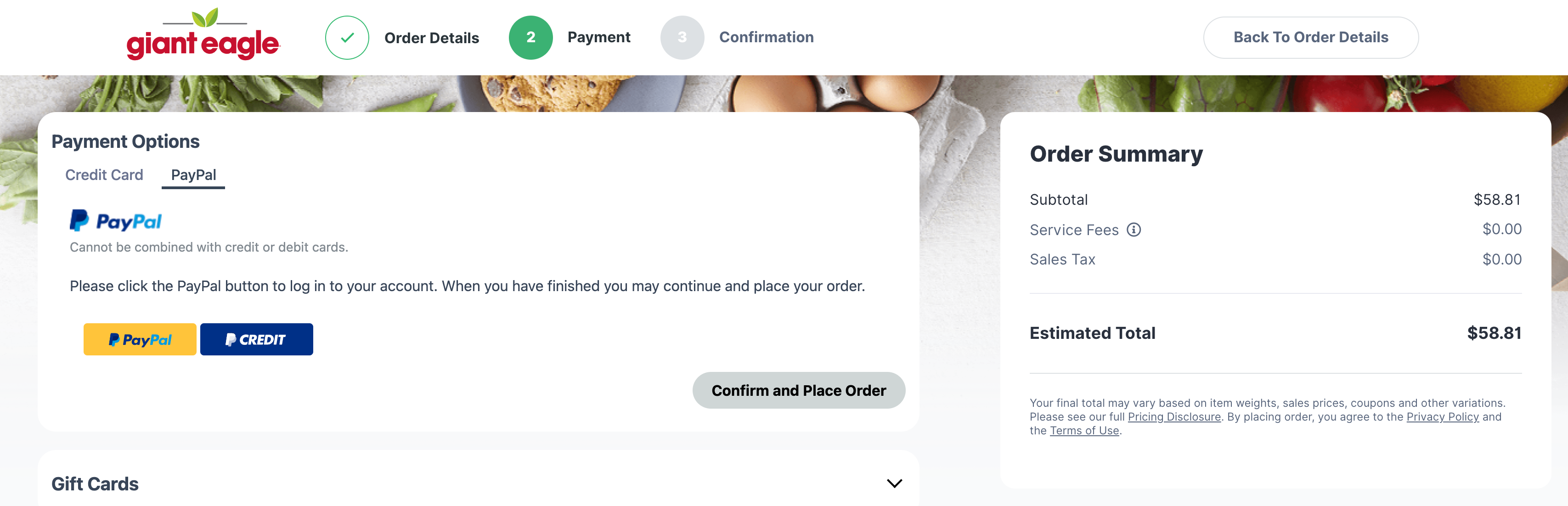

This popular cash-back card already offers 5% on rotating categories each quarter you activate, on up to the first $1,500 spent. This quarter is an especially lucrative one for PayPal and Walmart purchases.

Tons of major retailers accept PayPal as a payment method at checkout, unlocking tons of opportunities to earn 5% on a wide variety of purchases. And it doesn’t stop there. The Freedom Flex comes with 5% cash back on travel booked through Ultimate Rewards, 3% on dining and drugstore purchases, and 1% on all other purchases — all for no annual fee.

With strategy involved, you could stack this new promo with the current earning rate to potentially earn up to 19,500 Ultimate Rewards points this quarter — worth a tremendous $390 according to TPG’s valuations.

Best of all, there’s not just one way to go about this. In this post, we’ll provide some ideas on maximizing this promotion to its full potential.

In This Post

How to maximize this promotion

First, let’s review the “top spend categories” that can earn 5% back. The math breaks down to earning an additional 4% plus the 1% earning rate on base purchases:

- Travel, including transit.

- Dining.

- Home improvement stores.

- Groceries, not including Target and Walmart.

- Drugstores.

- Gas stations.

- Select live entertainment.

- Select streaming services.

- Fitness clubs.

Upon reviewing these spending categories, create a game plan and focus on one category that you’re most likely to spend on from now until the end of this year and where you can use PayPal simultaneously — allowing you to double-dip your earnings this quarter.

How to use PayPal virtually anywhere

For starters, add your Freedom Flex (and any other card you wish) to your PayPal account. Thousands of online retailers allow PayPal as a payment method at checkout, which comes in handy as we approach this holiday shopping season. This makes it incredibly easy to maximize the $1,500 spending limit on this quarter’s quarterly bonus category (and, of course, Walmart, too).

But beyond paying with PayPal at checkout for online purchases, here are some ways you can use PayPal when shopping in person:

- Add your PayPal account to your Samsung Pay and pay at virtually any store that accepts contactless payment methods. Unfortunately, adding PayPal to Google Pay or Apple Pay isn’t possible at the time of writing.

- Download the PayPal app and designate your Freedom Flex as your primary payment method. Some stores may accept PayPal QR codes as a payment method, so press the QR code in the upper right corner of the app and scan to pay.

Below, we’ve given you some ideas on ways to maximize this promotion — and how many points you could potentially earn this quarter.

Related: Why earning 5x from home is extremely easy this quarter

Earn 13x on groceries

Groceries are one of the most common everyday expenses and a top spending category option for this promotion. Luckily for you, it’s also the most lucrative option this quarter — with the potential of earning a whopping 13 points per dollar on these purchases.

That’s in part due to the Chase Freedom Flex’s current sign-up bonus, which is twofold: Earn $200 cash back after spending $500 on purchases in the first three months of account opening. Plus, earn 5% on grocery stores (excluding Target and Walmart) on up to $12,000 spent in the first year of account opening.

If you’re within this first-year window — and haven’t yet maximized this $12,000 spending limit — you could combine all of these terrific offers together to earn up to 13x on grocery stores:

- Base points: 1x on all non-bonus purchases.

- As part of the sign-up bonus: Additional 4x on groceries, on the first $12,000 spent in the first year.

- As part of the promotion: Additional 4x on your top spending category, on up to $1,500 spent this quarter.

- As part of rotating categories: Additional 4x on PayPal, on up to $1,500 spent this quarter.

That’s a total of 13x on groceries by paying with PayPal and leveraging the sign-up bonus.

Earning 13x on groceries on up to $1,500 spent this quarter equates to a whopping 19,500 Ultimate Rewards points, carrying an incredible $390 of value — and an impressive 26% return on groceries!

If you carry a card like the American Express® Gold Card, famously known for its 4x on groceries at U.S. supermarkets (on up to $25,000 in purchases per calendar year; then 1x) and dining at restaurants, it’s worthwhile to put that card to rest for now and switch over your grocery spending to your Freedom Flex until you meet that $1,500 cap by the end of 2021.

Even if you no longer have the grocery bonus offer through your sign-up bonus anymore, that still equates to earning 9 points per dollar on up to $1,500 spent. If you maximize to the $1,500 spending limit, you’re looking at 13,500 potential points:

- Base points: 1x on all non-bonus purchases.

- As part of the promotion: Additional 4x on your top spending category, on up to $1,500 spent this quarter.

- As part of rotating categories: Additional 4x on PayPal, on up to $1,500 spent this quarter.

That’s a total of 9x on groceries paid with PayPal.

Earn 11x at drugstores

Drugstore purchases are another category included in this top spending offer. Since the Freedom Flex earns 3x on drugstore purchases as part of its ongoing rewards rate, here’s how the bonuses can stack:

- Base points: 3x on drugstore purchases.

- As part of the promotion: Additional 4x on drugstore purchases, on up to $1,500 spent this quarter.

- As part of rotating categories: Additional 4x on PayPal, on up to $1,500 spent this quarter.

That’s a total of 11x on drugstore purchases paid with PayPal.

If you maximize the $1,500 spending limit at drugstores this quarter and pay with PayPal, that’s 16,500 Ultimate Rewards points you could be earning this quarter!

In 2020, CVS started partnering with PayPal to accept PayPal and Venmo QR codes at checkout to add more options for contactless payments.

Pro tip: You can get $10 cash back on your first purchase of $20 or greater at CVS when you pay with your PayPal QR code.

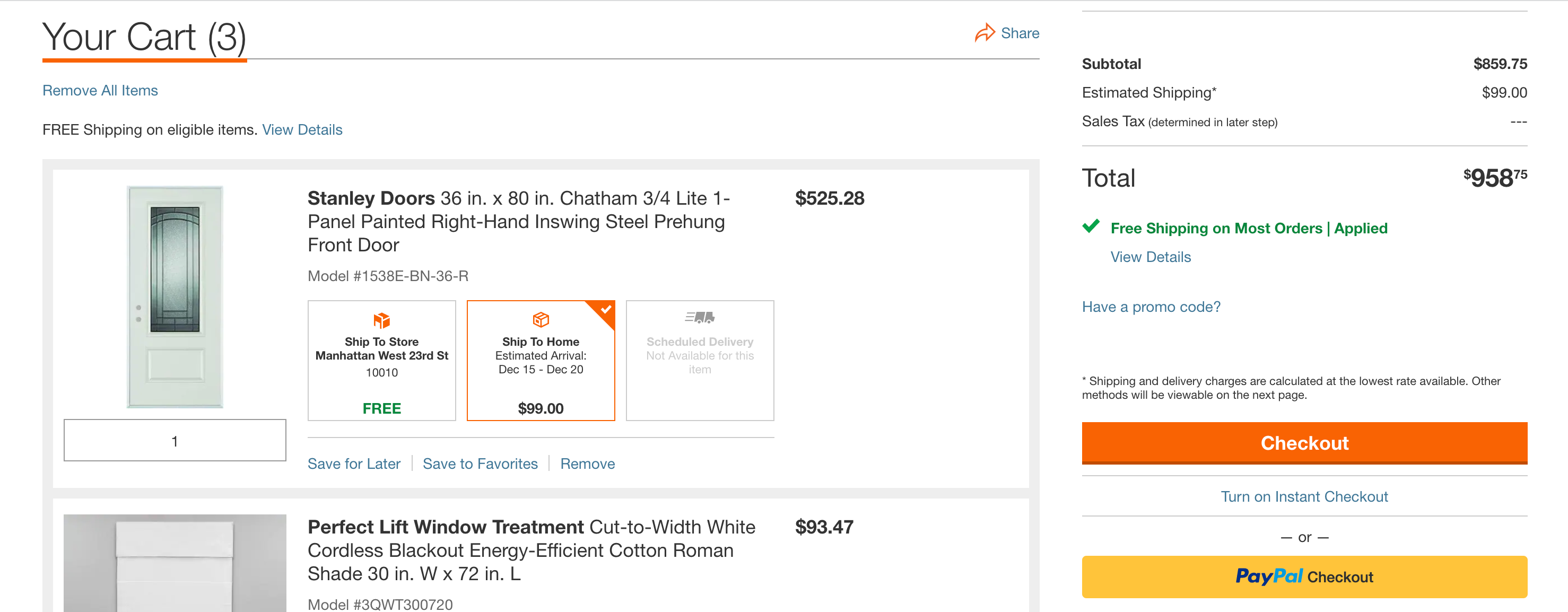

Earn 9x at home improvement stores

Whether you’re redesigning your office or anticipating a massive home renovation, it’s not a surprise that these costs can add up quite quickly. If you decide to hone in on home improvement stores for your top spending category, you could earn 9 points per dollar:

- Base points: 1x on all non-bonus purchases.

- As part of the promotion: Additional 4x on your top spending category, on up to $1,500 spent this quarter.

- As part of rotating categories: Additional 4x on PayPal, on up to $1,500 spent this quarter.

That’s a total of 9x at home improvement stores when paid with PayPal.

For instance, you can use “PayPal Checkout” on Home Depot’s website and pay with your Freedom Flex to sweep up those 9 points per dollar — or 13,500 Ultimate Rewards points if you maximize the $1,500 spending limit.

Earn 9x on travel

The Chase Freedom Flex offers 5% on travel booked through Ultimate Rewards. You can book flights, hotels, rental cars, cruises and more on the portal. If you decide to make this your top spending category, you could earn 9 points per dollar:

- Base points: 5x on all non-bonus purchases.

- As part of the promotion: Additional 4x on your top spending category, on up to $1,500 spent this quarter.

That’s a total of 9x on travel purchased through Ultimate Rewards.

Again, you’d be earning 13,500 Ultimate Rewards points. For $1,500 in spending, that yields a remarkable 18% return.

Earn 7x on dining

In addition to earning 3x on drugstore purchases, the Chase Freedom Flex offers 3x on dining as well. While it’s more uncommon that restaurants would accept PayPal as a payment method (though not impossible), you could still earn 7x without maximizing this quarter’s rotating categories. Here’s how:

- Base points: 3x on dining purchases.

- As part of the promotion: Additional 4x on your top spending category, on up to $1,500 spent this quarter.

That’s a total of 7x on dining.

When you maximize the $1,500 spending limit, you’ll earn 10,500 Ultimate Rewards points.

While there are many cards out there that offer fantastic returns on dining purchases, consider switching over to your Freedom Flex — at least for this quarter — to lock in an unbelievable 14% return.

FAQs about the Freedom Flex top spending offer

This promotion can be confusing since there’s a lot of math involved. Below, we’ve answered your questions about this new promotion:

How is the top spending category promotion calculated?

On your eligible top spending category this quarter (Oct. 1 to Dec. 31), you’ll earn 5% cash back on up to the first $1,500 spent. Note that it’s calculated as an additional 4% cash back on top of the base rate (1%) you earn on all purchases, for a cumulative total of 5% back. For purchases that earn a bonus with the Freedom Flex already, such as 3% on dining or drugstores, you’ll just have to add 4% on top to get a 7% earning rate.

What purchases count under the top spending category promotion?

Travel (including transit), dining, home improvement stores, grocery stores (not including Target and Walmart), drugstores, gas stations, select live entertainment, select streaming services and fitness clubs.

Does this promotion apply to the Chase Freedom (no longer available to new applicants)?

No. This offer is only valid for Chase Freedom Flex cardholders.

When will I receive my bonus points from the top spending category promotion?

Your bonus points will be tallied after the quarter ends — Dec. 31. Allow up to eight weeks for the points to be added to your Ultimate Rewards balance.

What is included in the ‘select live entertainment’ category?

Chase defines this category as “merchants [that] sell tickets for in person entertainment such as major sporting events, zoos and aquariums, concerts, theatrical productions, museums tourist attractions and exhibits, amusement parks, circuses, carnivals, bands, and entertainers. Ticket agencies selling on behalf of the entertainment venue are included. Some merchants that sell tickets for in person entertainment are not included in this category; for example, movie theaters, bowling alleys, horse racing tracks, casinos, and dance hall/clubs. Purchasing from a hotel/concierge is not included nor excursions or purchases as part of a travel package.”

What is included in the ‘select streaming services’ category?

Only the following subscriptions are included in this category: Disney+, Hulu, ESPN+, Netflix, Sling, Vudu, FuboTV, Apple Music, SiriusXM, Pandora, Spotify and YouTube TV.

Bottom line

Ultimate Rewards points are among the most prized award currencies out there, and earning thousands more of them just got possible with this new Freedom Flex offer.

This new top spending category promotion becomes even more valuable by leveraging this quarter’s 5% bonus category of Walmart and PayPal purchases. If you haven’t applied for the Freedom Flex yet, there’s no better time to jump right in than with this top spending offer roaming around.

Official application link: Chase Freedom Flex with a $200 sign-up bonus after spending $500 in the first three months of account opening.

Featured photo by John Gribben for The Points Guy.